Florida Lost Title Bond: A Comprehensive Guide

This guide provides information for insurance agents to help their customers obtain a Florida Lost Title Bond

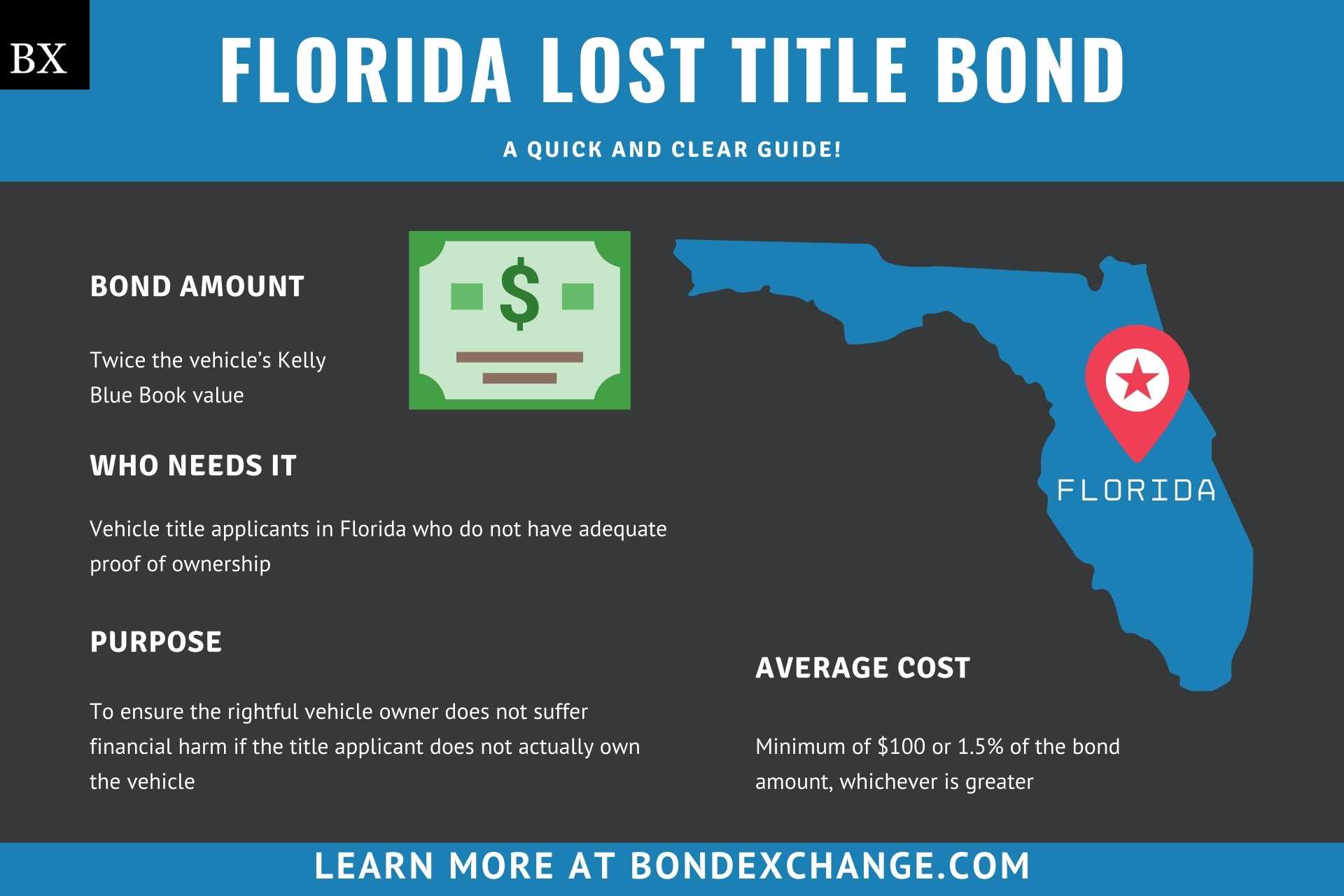

At a Glance:

- Lowest Cost: $100 per year

- Bond Amount: Twice the vehicle’s Kelly Blue Book value

- Who Needs it: Vehicle title applicants in Florida who do not have adequate proof of ownership

- Purpose: To ensure the rightful vehicle owner does not suffer financial harm if the title applicant does not actually own the vehicle

- Who Regulates Lost Title Bonds In Florida: The Florida Department of Highway Safety and Motor Vehicles

Background

Florida statute 319.23 requires residents who never received or have lost their vehicle title to purchase a surety bond prior to obtaining their duplicate title. The Florida legislature enacted the bonding requirement to ensure that the rightful vehicle owner will receive compensation if the title applicant does not actually own the vehicle. The bond amount must be equal to twice the vehicle’s Kelly Blue Book value and will expire three years from its effective date.

What is the Purpose of the Florida Lost Title Bond?

Florida requires residents to purchase a surety bond as part of the application process to obtain a duplicate title. The bond ensures that the rightful vehicle owner will not suffer a financial loss if the title applicant is seeking to obtain the title fraudulently. If the title applicant is engaging in fraud, then the rightful vehicle owner can file a claim against the bond and receive compensation up to the full amount of the bond. In short, the bond acts as a safeguard against people attempting to obtain ownership of a vehicle through unethical means.

How Can an Insurance Agent Obtain a Florida Lost Title Bond?

BondExchange makes obtaining a Florida Lost Title Bond easy. Simply log in to your account and use our keyword search to find the “title” bond in our database. Don’t have a login? Gain access now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone at (800) 438-1162, email, or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

Not an agent? Then let us pair you with one!

Click the above image to find a BX Agent near you

How is the Bond Amount Determined?

Florida statute 319.23 dictates that the bond amount must be equal to twice the vehicle’s Kelly Blue Book value.

Is a Credit Check Required for the Florida Lost Title Bond?

Surety companies will not conduct a credit check for bonds that are less than $25,000. At limits over $25,000, surety companies will review the applicant’s credit standing to determine qualification for the bond. For larger bond amounts, applicants with poor credit may be subject to a higher rate. Generally, most carriers want to have an understanding as to how the applicant came to have ownership of the vehicle.

How Much Does the Florida Lost Title Bond Cost?

The Florida Lost Title Bond costs either $100 or 1.5% of the bond amount, whichever is greater (rates may vary for bonds greater than $25,000).

Who is Required to Purchase a Bond?

The Florida Department of Highway Safety and Motor Vehicles will require a title applicant to purchase a surety bond if the applicant cannot present the department with a certificate of title that assigns the prior owner’s interest in the motor vehicle. Typically, lost title bonds are required for the following reasons:

- The vehicle has never been titled

- The applicant never received the title

- The previous owner never titled the vehicle

- The applicant has the title but there is an error in the title transfer

- The applicant purchased an unclaimed/abandoned vehicle and is not a bonded agent

How do Florida Residents Apply for a Bonded Title?

To apply for a bonded title, Florida residents must complete the following steps:

Step 1 – Consult the Local Tax Collector

Bonded title applicants in Florida should consult with their local tax collector’s office prior to purchasing a surety bond. Florida does not require all duplicate title applicants to obtain a bonded title, and title applicants should ensure that they actually need a bond before purchasing one.

Step 2 – Purchase a Surety Bond

Once they get confirmation from their local tax office, bonded title applicants must purchase and maintain a surety bond in an amount equal to twice the vehicle’s Kelly Blue Book value.

Step 3 – Complete the Affidavit

Florida requires bonded title applicants to submit an affidavit verifying the vehicle’s VIN number, detail the circumstances in which the applicant obtained ownership of the vehicle, and discloses that there are no security interests or liens against the vehicle.

Step 4 – Complete the Application

After purchasing their bond and filling out the affidavit, bonded title applicants in Florida must complete the title application and submit it, along with their bond and affidavit, to their local tax collector’s office.

How Do Florida Bonded Title Applicants File Their Bond?

In Florida, bonded title applicants should submit the completed bond form, including the power of attorney, to their local tax collector’s office. The Florida Lost Title Surety Bond requires signatures from both the surety company that issues the bond and the bonded title applicant. The surety company should include the following information on the bond form:

- The legal name of entity/individual(s) buying the bond

- Surety company’s name, address, and phone number

- Bond amount

- Vehicle information

- Date the bond goes into effect

- Date the bond is signed

What Are the Insurance Requirements for Bonded Title Applicants in Florida?

Florida requires all motor vehicle owners to purchase auto insurance with the following minimum limits:

- $10,000 personal injury protection

- $10,000 property damage protection

Bonded title applicants must purchase and maintain a surety bond in an amount equal to twice the vehicle’s Kelly Blue Book value.

How Can Florida Residents Avoid Claims Against Their Lost Title Bond?

To avoid claims against their bond, bonded title applicants in Florida must ensure that they are the rightful owners of the motor vehicle.

What Other Insurance Products Can Agents Offer Bonded Title Applicants in Florida?

Florida requires all motor vehicle owners to purchase auto insurance. Bonds are our only business at BondExchange, so we do not issue other types of insurance, but our agents often utilize brokers for this specific line of business. A list of brokers in this space can be found here.