Lost Stock Certificate Bond: A Comprehensive Guide

This guide provides information for insurance agents to help their customers obtain a Lost Stock Certificate bond

What is a Lost Stock Certificate Bond?

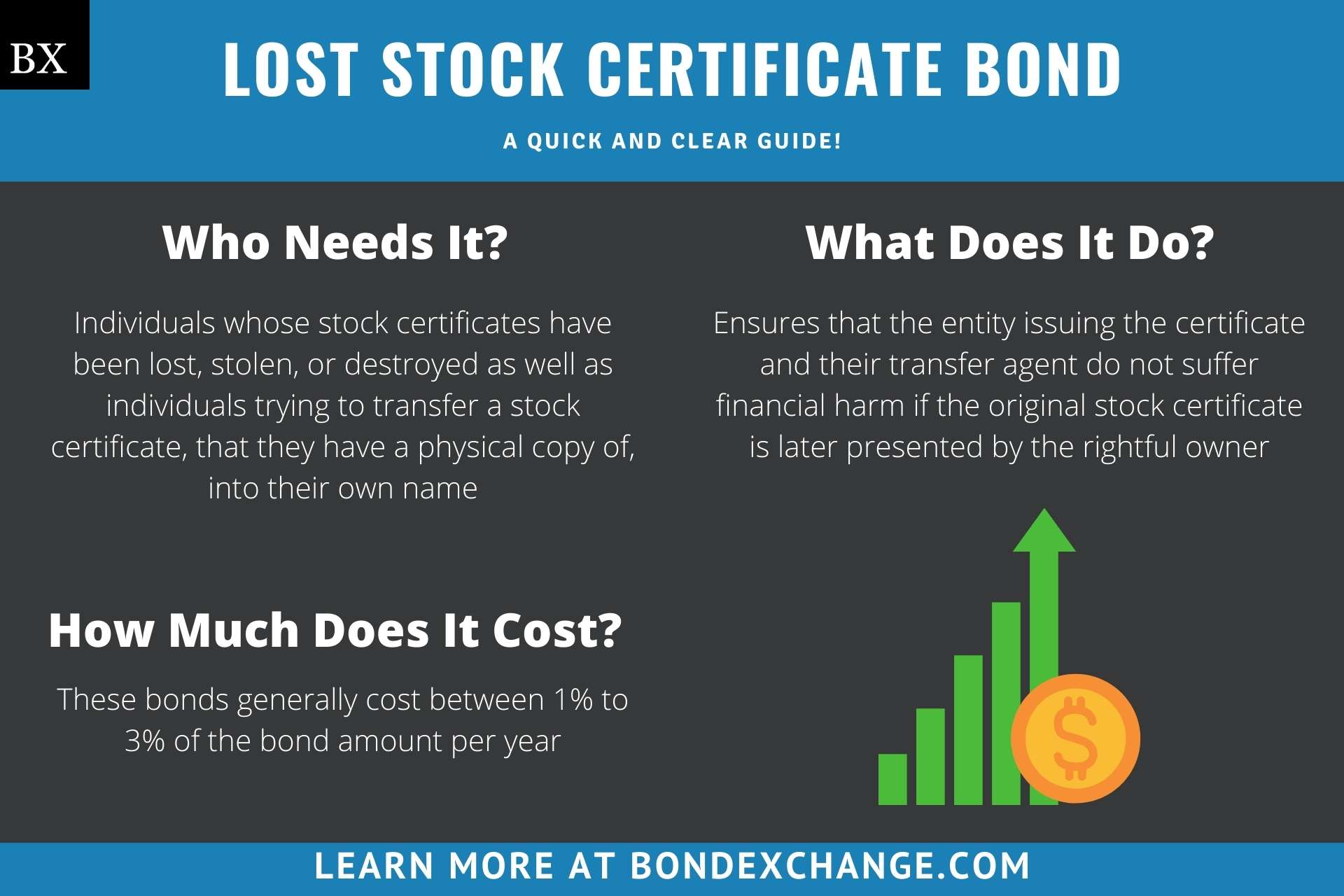

Lost stock certificate bonds, sometimes referred to as lost instrument bonds, are surety bonds that individuals whose stock certificates are lost, stolen, or destroyed must purchase prior to being issued a duplicate certificate. Lost stock certificate bonds ensure that the entity issuing the certificate (the company whose stock is being purchased) and their transfer agent do not suffer financial harm if the original stock certificate is later presented by the rightful owner.

For example, imagine a man has just inherited $100,000 worth of stock. However, he cannot find the physical stock certificates so he is therefore unable to sell the stock. He still owns the stock, but without the stock certificate he does not meet the proof of ownership threshold required to trade the stock in any way. He proceeds to call the company’s designated transfer agent in charge of issuing certificates to request a replacement. The transfer agent informs him that prior to receiving a duplicate certificate, he must purchase a surety bond to ensure that the rightful stock owner will receive compensation for the shares should it turn out he does not actually own the stock.

Simply put, lost stock certificate bonds provide financial security to the company issuing the stock, their transfer agent, and the rightful stock owner if the individual requesting the certificate does not actually own the stock.

Most businesses require individuals to purchase a surety bond as a prerequisite for receiving a duplicate stock certificate.

Unlike most insurance products, surety bonds protect a third party from acts that are violations of the law. When the surety company suffers a loss due to the duplicate stock certificate applicant’s actions, the applicant must repay to the surety company any losses and sometimes court costs and other fees.

How Can an Insurance Agent Obtain a Lost Stock Certificate Surety Bond?

BondExchange makes obtaining a Lost Stock Certificate surety bond easy. Simply log in to your account and use our keyword search to find the “securities” bond in our database. Don’t have a login? Gain access now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone at (800) 438-1162, email, or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

Not an agent? Then let us pair you with one!

Click the above image to find a BX Agent near you

What is a Stock Certificate?

A stock certificate is a physical document that serves as a representation of an individual’s ownership interest in a company. The certificate will include the investor’s name, the number of shares owned, and signatures from an executive officer of the company issuing the stock. The vast majority of stocks are traded electronically through brokerage firms. However, investors can still request a physical stock certificate from the company who issued them the stock or through their broker.

Who Requires Lost Stock Certificate Bonds?

Unlike other types of surety bonds, lost stock certificate bonds are not required by a government agency, but rather by the individual companies that issue the certificates. However, most companies utilize transfer agents to record investment transactions and issue certificates. If the investor is receiving their certificate through a transfer agent, then the obligee (entity requiring the bond) will be the transfer agent and not the company issuing the stock.

Who is Required to Purchase a Lost Stock Certificate Bond?

Individuals whose stock certificates have been lost, stolen, or destroyed must purchase a surety bond prior to being issued a new certificate. Additionally, individuals trying to transfer a stock certificate, that they have a physical copy of, into their own name must purchase a bond if the individual listed on the certificate did not initiate the transfer.

What is the Limit on a Lost Stock Certificate Bond?

The limit on a lost stock certificate bond will be equal to the current market value of the stock at the time the bond is issued. However, these bonds are “open penalty”, which means the maximum amount of funds the surety company will payout for a claim will be equal to the current value of the stock certificate at the time the claim is made.

For example, if an investor purchases a $100,000 stock certificate bond and a valid claim is made while the stock is worth $150,000, then the surety company will be liable to pay out a $150,000 claim. Alternatively, if the stock’s value decreased to $50,000 at the time of a claim, then the surety company will only need to pay out a maximum of $50,000, even though the original limit was $100,000.

What are the Underwriting Requirements for Lost Stock Certificate Bonds?

Underwriters will examine the following criteria when determining if your customer qualifies for a lost stock certificate bond:

- Validity of the claim: Underwriters will examine the validity of your customer’s claim to obtain a duplicate certificate. Your customer is more likely to be approved for coverage if they have credible evidence supporting that they do in fact own the stock

- Credit score: Surety underwriters will review your customer’s personal credit to determine their eligibility and rate for lost stock certificate bonds. Most carriers use a “soft check”, so the credit review will not affect the applicant’s credit.

- Financial statements: For larger bond amounts, typically over $50,000, underwriters will examine your customer’s personal financial statements

How Much Does a Lost Stock Certificate Bond Cost?

Lost stock certificate bonds generally cost between 1% to 2% of the bond amount per year. Applicants with the best credit and financial statements can expect to pay the lowest rates, while applicants with poor credit will pay higher rates.

Do Surety Companies Offer Financing on Lost Stock Certificate Bonds?

Most lost stock certificate bond premiums can be financed. To be eligible, the bond must have a cancellation provision in the bond form. Premium finance companies usually charge a finance fee and interest rate to provide the financing. BondExchange offers in-house payment plans for bond premiums over $500. Our payment plans are interest-free and can be set up instantly online with a customer credit card and a few clicks. We offer this option automatically for bonds that meet the eligibility requirements.

How Can Your Customers Obtain a Duplicate Stock Certificate?

To obtain a duplicate stock certificate, your customers will generally need to complete the following steps:

Step 1 – Initiate a Stop Transfer

Once your customer is made aware that their certificate has been lost, stolen, or replaced they must contact the company’s transfer agent and request that a “stop transfer” be initiated to ensure their stock is not transferred over to another individual

Step 2 – Present their Case

After initiating a stop transfer, your customers must present all evidence that they do in fact own the stock and are eligible to receive a duplicate certificate

Step 3 – Purchase a Surety Bond

Your customers must purchase and maintain a surety bond in an amount equal to the value of the stock certificate at the time the bond is issued

Step 4 – Request a New Certificate

After completing all of the above steps, your customer may request a duplicate stock certificate

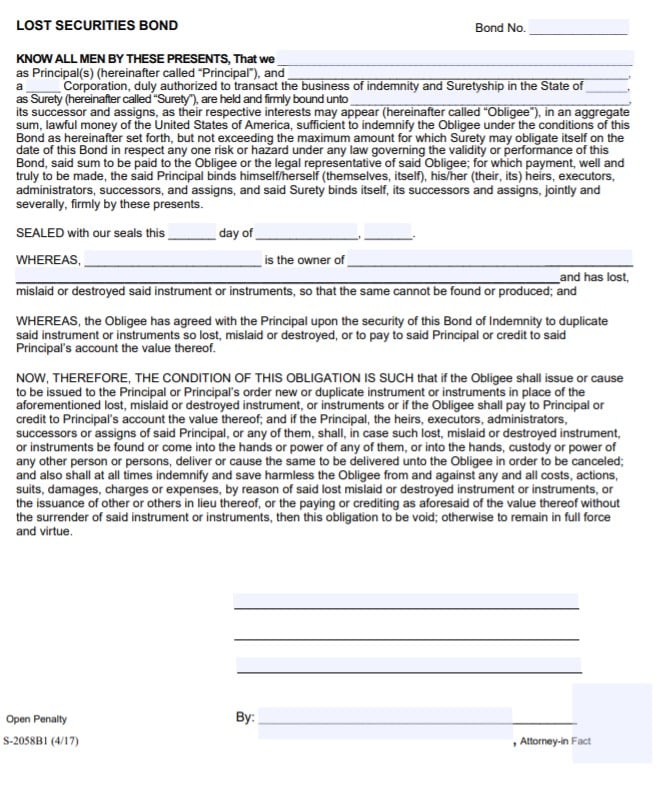

How Are Lost Stock Certificate Bonds Filed?

Surety bond companies will provide your customers with a completed surety bond to be filed with the company issuing the stock certificate or their transfer agent. Most companies will require the original bond with a raised surety company seal to be filed by mail.

Surety companies should include the following information on most bond forms:

- Legal name of entity/individual(s) buying the bond

- Surety company’s name

- Obligee’s name

- Date the bond is signed

- Signatures of the surety representative

- Date the bond is effective and issued

- Corporate seal of the surety company

- Power of Attorney

What Can Your Customers Do to Avoid Claims Against Their Lost Stock Certificate Bond?

To avoid claims against their bond, your customers must ensure that they are the rightful owners of the stock and that no one else has a valid ownership claim.