Florida Public Official Bond: A Comprehensive Guide

This guide provides information for insurance agents to help their customers obtain a Florida Public Official bond.

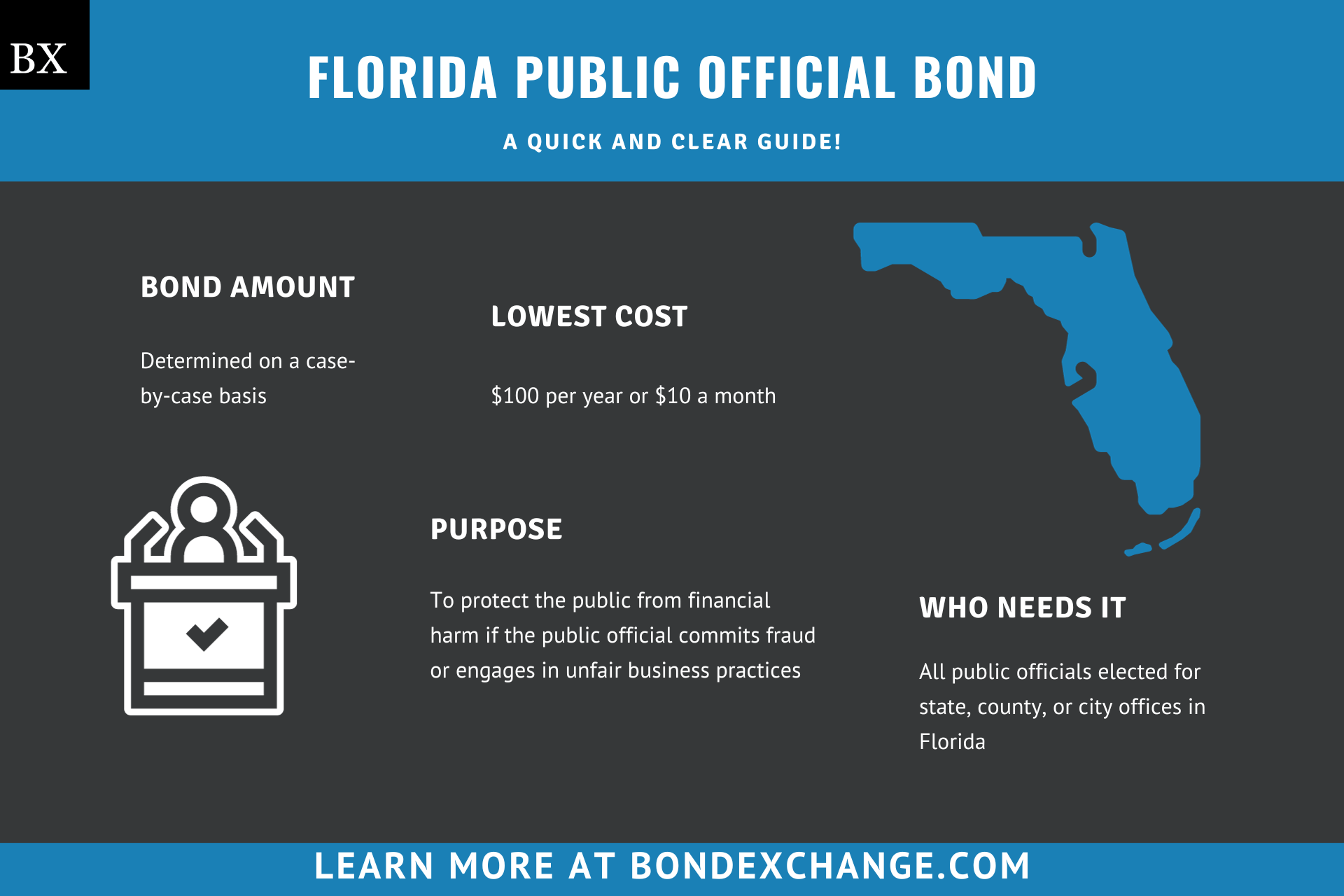

At a Glance:

- Lowest Cost: $100 per year or $10 a month

- Bond Amount: Determined on a case-by-case basis (more on this later)

- Who Needs It: All public officials elected for state, county, or city offices in Florida

- Purpose: To protect the public from financial harm if the public official commits fraud or otherwise abuse their position of power

- Who Regulates Public Officials in Florida: The Florida Secretary of State

Background

Florida Statutes 113.07 requires all public officials elected for a state, county, or city position to obtain a surety bond before being sworn in for their office term. The Florida Legislature enacted the surety bond requirement to ensure that public officials do not abuse their position of power. To provide financial security for enforcing such laws, public officials must purchase and maintain a surety bond to be eligible for their elected position.

What Is the Purpose of the Florida Public Official Bond?

Florida Statutes 113.07 requires all public officials to purchase a surety bond as part of the process of being sworn into office. The bond ensures that restitution is available to any damaged party should the public official fail to abide by the regulations outlined in the Florida Statutes Title X, Chapters 110-122. Specifically, the bond protects claimants if the public official commits fraud or otherwise abuses their position of power. In short, the bond is a type of insurance that protects the public if the public official violates the terms surrounding their elected position.

How Can an Insurance Agent Obtain a Florida Public Official Bond?

BondExchange makes obtaining a Florida Public Official bond easy. Simply log in to your account and use our keyword search to find the “public official” bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email, or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

Not an agent? Then let us pair you with one!

Click the above image to find a BX Agent near you

How Is the Florida Public Official Bond Amount Determined?

The limit on the Florida Public Official bond can significantly vary based on the locale and elected official’s position. In most cases, a Public Official Bond limit is determined by the state governor and it must be in an amount they deem necessary for any elected official in said department, institution, commission, bureau, board, or agency.

Is a Credit Check Required for the Florida Public Official Bond?

If the Florida Public Official bond limit is under $50,000, a credit check is not required. Because the bond is considered relatively low risk, the same rate is offered to all public officials in Florida regardless of their credit history.

How Much Does the Florida Public Official Bond Cost?

The Florida Public Official bond typically costs $100 per year or $10 per month. However, if the required bond limit is over $50,000 (this is unlikely), premium costs can vary. In most cases, rates sit at 0.5% of the bond amount.

According to Florida Statutes 113.07, the premium for a Public Official bond must be paid out of the General Revenue Fund for the state, county, or district that the public official belongs to.

Who Needs a Public Official Bond in Florida?

In most states, many government positions require a surety bond before they may be sworn in for their elected term. Public Official bonds cover town, city, or municipal governments, state government agencies, city and state courts, as well as community and state colleges.

Below is a general list of elected officials that may be required to obtain a Florida Public Official bond:

- Governor

- Mayor

- Attorney General

- State Auditor

- State Treasurer

- Fire Marshall

- Court Clerks

- Constable

- Tax Commissioner

- City Clerks or other City Officials

- Town Clerks or other Town Officials

- County Clerks or other County Officials

- Agents Selling Hunting and Fishing Licenses

The Florida Public Official bond must be filed with the office of the Secretary of State before the officeholder may be officially sworn in. The surety bond will generally run concurrently with the public official’s term of office.

BondExchange now offers monthly pay-as-you-go subscriptions for surety bonds. Your customers are able to purchase their bonds on a monthly basis and cancel them anytime. Learn more here.

What Are the Insurance Requirements for Public Officials in Florida?

In most cases, Florida does not require public officials to purchase any form of liability insurance as a prerequisite to being sworn into office. However, public officials must purchase and maintain a surety bond.

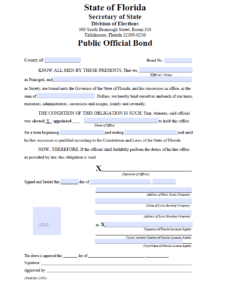

How Do Public Officials File Their Bonds in Florida?

Florida public officials should submit their completed bond forms, including the power of attorney, to the office of the Secretary of State (see the mailing address listed below).

Division of Elections

500 South Bronough Street, Room 316

Tallahassee, FL 32399

The surety bond requires signatures from the surety company, as well as the elected public official. The surety company should include the following information on the bond form:

- The legal name of the individual buying the bond

- Surety company’s name

- Date the bond is signed

What Can Florida Public Officials Do to Avoid a Claim Against Their Surety Bond?

To avoid claims against their bonds, public officials in Florida must follow all regulations regarding their elected position, including some of the most important issues below that tend to cause claims:

- Misrepresentation

- Negligence

- Misfeasance

- Malfeasance

- Fraud

What Other Insurance Products Can Agents Offer Public Officials in Florida?

Most governing institutions will purchase liability insurance covering losses pertaining to a public official committing fraud, negligence, or malfeasance. Bonds are our only business at BondExchange, so we do not issue any other types of insurance, but our agents often utilize brokers for this specific line of business. A list of brokers in this space can be found here.

How Can Insurance Agents Prospect for Public Official Customers in Florida?

Unfortunately, Florida does not provide a public list of active public officials in the state. We suggest contacting the Secretary of State through this resource for a list of active public officials in the state. Contact BondExchange for additional marketing resources. Agents can also leverage our print-mail relationships for discounted mailing services.