How to Properly File a Surety Bond

January 27, 2022

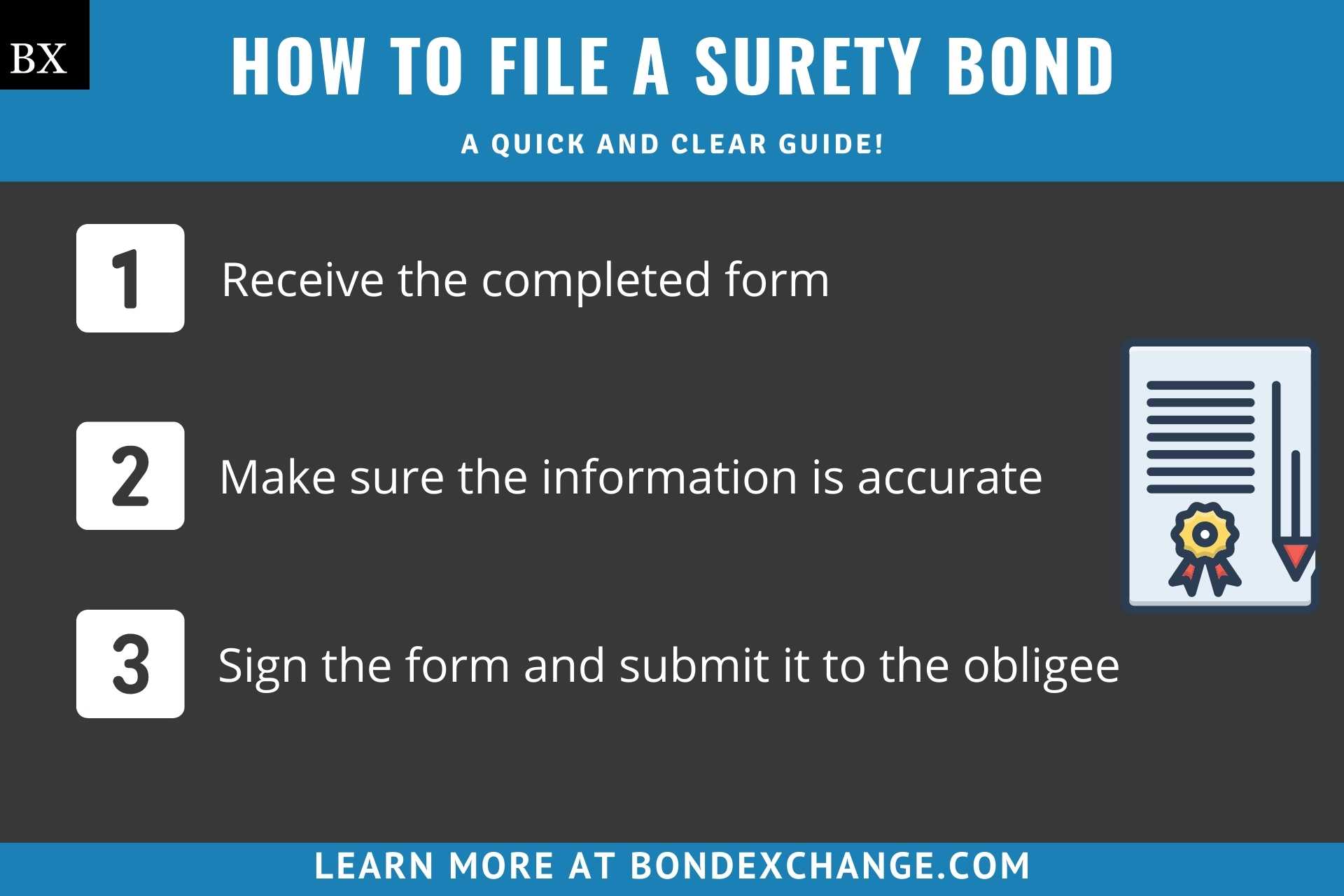

On the surface, filing a surety bond seems simple enough. The surety company provides your customer with the bond which must then be signed and submitted either electronically, in person, or via mail to the obligee’s address. However, some obligees are extremely picky, and if your customer does not follow their instructions to a T then their bond may end up being rejected. To ensure that your customers only need to file their bond once, we’ve put together this comprehensive guide highlighting the most common causes for rejection and explaining how your customers can properly file their surety bonds.

What is a Bond Form?

Surety bonds are a contract between the principal, the surety company, and the obligee, and the bond form is the physical document that represents the obligations that the three parties have made to each other. Bond forms are legally binding documents that if filled out incorrectly can be deemed invalid, leaving the obligee without a readily available recourse to recover losses if the principal violates the bond’s provisions. Whenever you hear the phrase “file a surety bond”, what is being referenced is the action of submitting the completed bond form to the obligee. To learn more about bond forms, check out our article located here.

How are Surety Bonds Filed?

As we previously discussed, your customer will file their bond by submitting the completed bond form to the obligee. Depending on the type of bond, this can be done either by mail (most common), electronically, or in-person if your customer lives within close proximity of the obligee.

Determining the required method for filing a bond can be challenging, and unless the form contains explicit instructions on how to complete the filing process, your customers may be left scratching their heads about where and how to submit it. It’s oftentimes worth giving the obligee a call and asking them where they would like the bond to be sent. Additionally, our team of underwriters here at BondExchange would be happy to assist you in determining how your customers’ bonds must be filed.

Why Do Bonds Get Rejected?

Most bonds that get rejected are filled out incorrectly, and while the surety company completes most of the form, your customers will need to provide signatures and ensure that the information is accurate. Additionally, some obligees are very particular about how the form must be filled out and will reject submissions that do not meet their standards. Below are the most common reasons why obligees reject surety bonds:

Inaccurate Information

Bond forms that contain inaccurate information will be rejected by the obligee. For example, your customer’s home address may be listed on the form instead of their business address, causing it to be rejected. Surety companies fill out bond forms based on the information provided by your customer. Therefore, it is imperative that your customer provides the correct information when filling out their bond application.

Obligees will also reject bonds that don’t specify your customer’s operating structure. If your customer operates an LLC, they must list their business as “XYZ business, LLC” on the bond form. The same is true for all other ownership types. Additionally, if the bond requires more in-depth information, like a vehicle’s make and model (for lost title bonds), your customers must ensure that all the information provided to the surety company is accurate and complete.

Wrong Bond Amount

Some bond forms do not state the required bond amount and require your customers to write in the limit themselves. Surety bonds do not protect your customers, but instead, act as insurance for the obligee. Therefore, to avoid their bonds being rejected it is imperative that your customers fill in the exact amount that the obligee is requiring. The obligee will always inform your customer of the required bond amount.

Spelling Errors

The information included in the bond form must be spelled correctly. Remember, bond forms are legal contracts that bind the principal, surety company, and obligee to the provisions contained therein. Typographical errors generally do not invalidate contracts. However, if the spelling mistake is severe enough to change the meaning of the text then the bond could potentially be deemed unenforceable if a claim were to occur. Obligees don’t want to run the risk of the bond being unenforceable, and as such will reject bonds with spelling errors.

Not Notarized

Many obligees require bond forms to be signed by a licensed notary to ensure that the principal is the actual individual signing the bond. Additionally, notaries will not sign the bond unless they physically witness your customer signing it. As such, make sure to advise your customers to hold off on signing their bond unless a notary is present.

Lack of Power of Attorney

Unless your customer’s bond form is signed by an executive officer of the surety company issuing it, then they must submit the power of attorney when filing their bond. Most surety bonds are issued through brokers, or third parties acting on behalf of the surety company. Therefore, surety companies will grant brokers power of attorney to act on their behalf when signing the bond. If your customer does not submit the power of attorney when filing their bond, then the obligee has no way of knowing that the surety company agreed to assume any liability, and will therefore reject it.

Signed by the Wrong Individual

All surety bonds must be signed by the individual or a representative of the organization that is agreeing to adhere to the bond’s provisions. If the bond is required for an individual, then it must be signed by the person being issued the bond, not by their spouse, lawyer, family member, or any other individual not expressly listed as the principal. If the bond is being issued to a business, then a company owner or executive officer must sign the bond for it to be considered valid.

How can Agents Ensure Their Customers’ Bonds are Filed Correctly?

The best way to ensure your customer’s bond does not get rejected is to make sure that they provide the correct information when submitting their bond application. If approved for coverage, surety companies will utilize this information when filling out the bond form. Applications are often hastily filled out in an attempt to speed up the process. However, diligently filling out the application to ensure all of the information is accurate will save your customers time and effort in the long run. Incorrect bond forms lead to time-consuming correspondences with obligees and a correction rider having to be mailed out to resolve the issue(s). Your customers can avoid the hassle that comes with rejection by ensuring that they take the time to properly complete their application and by following all the points outlined above.

How Can an Insurance Agent Obtain a Surety Bond?

BondExchange makes obtaining surety bonds easy. Simply log in to your account and use our keyword search to find your bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone at (800) 438-1162, email, or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.