Kentucky Conservator Bond: A Comprehensive Guide

This guide provides information for insurance agents to help their customers obtain a Kentucky Conservator bond.

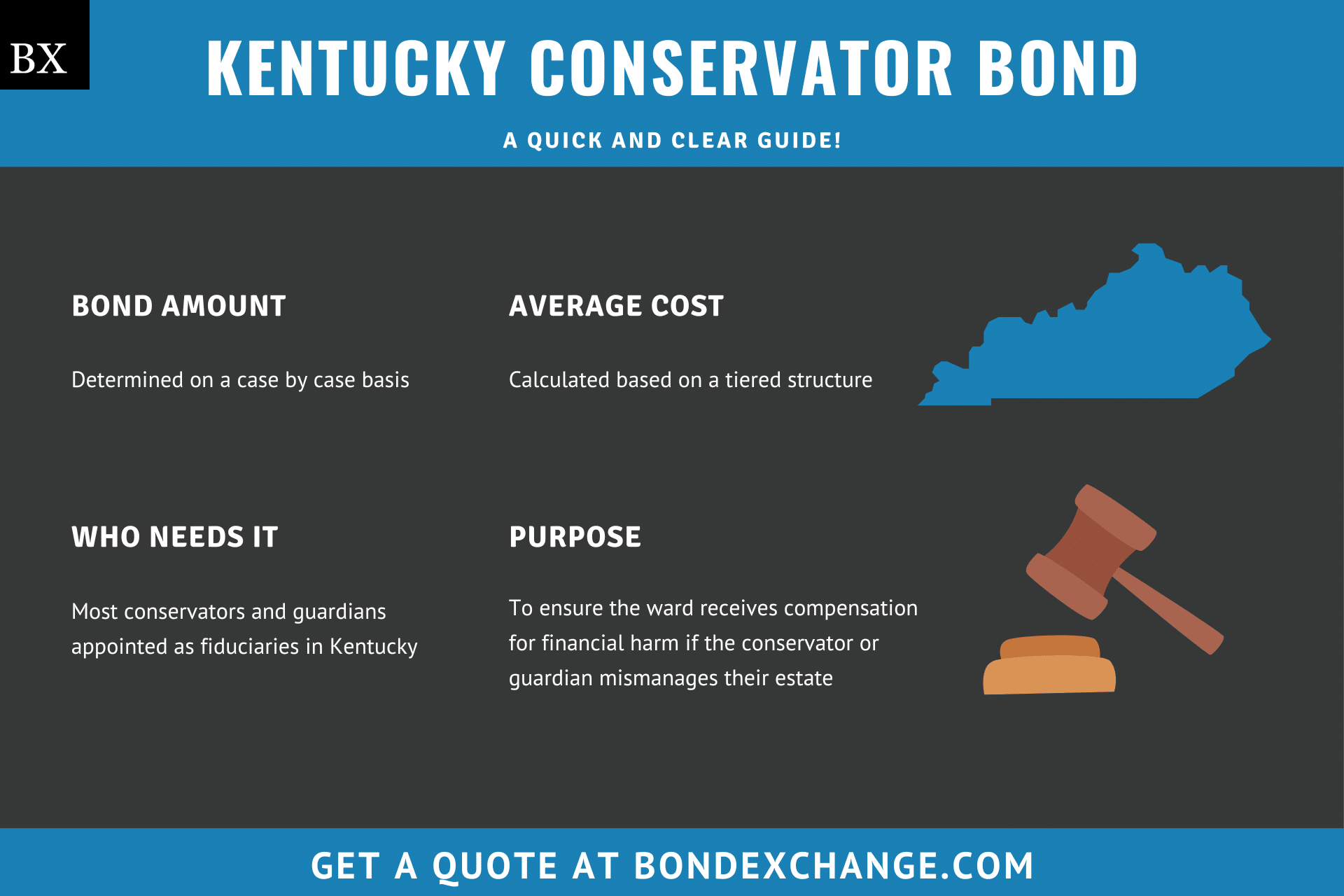

At a Glance:

- Average Cost: Calculated based on a tiered structure

- Bond Amount: Determined on a case-by-case basis (more on this later)

- Who Needs It: Most conservators and guardians appointed as fiduciaries in Kentucky

- Purpose: To ensure the ward receives compensation for financial harm if the conservator mismanages their estate

- Who Regulates Conservator Bonds in Kentucky: The district court of the county where the ward resides or has property

Background

Kentucky Statute 387.025 requires all conservators and guardians to be appointed by a court before assuming their fiduciary duties. The Kentucky legislature enacted the appointment requirement to ensure that conservators and guardians act in the ward’s best interests when managing their estate or making decisions related to their health. To provide financial security for the enforcement of this requirement, most conservators and guardians must purchase and maintain a probate surety bond before becoming appointed as a fiduciary.

What is the Purpose of the Kentucky Conservator Bond?

Kentucky requires most conservators and guardians to purchase a surety bond as a prerequisite to being appointed as a fiduciary. The bond ensures that the ward will receive compensation for financial harm if the conservator or guardian fails to abide by the regulations outlined in Kentucky Statute 387.070. Specifically, the bond protects the ward if the conservator or guardian fails to adhere to all court orders or mismanages the estate’s assets.

For example, if a conservator or guardian uses money from the ward’s bank account to pay for personal expenses or mixes the estate’s funds with their own, the ward can file a claim against the fiduciary’s bond to recoup their losses. In short, the bond is a type of insurance that protects the ward if the conservator or guardian does not fulfill their fiduciary duties.

How Can an Insurance Agent Obtain a Kentucky Conservator Bond?

BondExchange makes obtaining a Kentucky Conservator bond easy. Simply log-in to your account and use our keyword search to find the “Conservator” bond in our database. Don’t have a login? Gain access now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

Not an agent? Then let us pair you with one!

Click the above image to find a BX Agent near you

How is the Bond Amount Determined?

Kentucky Statute 388.270 dictates that the bond amount must be, at a minimum, equal to the value of the estate’s personal property plus the anticipated income to be generated by the estate over the next year. The court will determine the final bond amount in each case.

What are the Underwriting Requirements for the Kentucky Conservator Bond?

Most surety companies will examine the following factors when determining eligibility for the Kentucky Conservator bond:

- Fiduciary’s credit history

- Whether or not the estate has an attorney

- Whether or not the fiduciary is a family member

- The fiduciary’s occupation

- Whether or not the guardian or conservator is replacing a prior fiduciary

- If the fiduciary has ever committed a felony

- Whether or not there is any ongoing business in the estate

- If a creditor is requiring the bond

- If the bond amount is greater than or equal to the estate’s value

How Much Does the Kentucky Conservator Bond Cost?

Surety companies typically determine the premium rate for Conservator bonds based on a tiered structure, so larger bond amounts will be charged a lower premium rate than smaller bonds. Kentucky Statute 388.270 allows for the ward’s estate to pay for the cost of the bond.

The following table illustrates the pricing structure for the Kentucky Conservator bond:

$1,500,000 Conservator Bond Cost

| Bond Amount | Premium Rate | Total Bond Cost |

|---|---|---|

| First $20,000 | 0.75% | $150 |

| Next $40,000 | 0.60% | $240 |

| Next $140,000 | 0.50% | $700 |

| Next $300,000 | 0.375% | $1,125 |

| Next $1,000,000 | 0.25% | $2,500 |

| Total cost of $4,715 |

Who is Required to Purchase the Bond?

Kentucky requires most conservators and guardians to purchase a surety bond as a prerequisite to becoming a court-appointed fiduciary. To paraphrase Kentucky Statute 387.010, a “conservator” is an individual or corporation appointed as a fiduciary to act or make decisions over a ward’s estate or financial affairs. Likewise, a “guardian” is an individual or corporation appointed as a fiduciary to provide care and manage the personal affairs of a ward. Additionally, a “ward” is defined as a minor or disabled adult that is incapable of making sound decisions concerning their personal or financial affairs.

Conservators or guardians are not required to purchase a surety bond, unless explicitly required by the court, if:

- The guardian is appointed under a limited guardianship

- The guardian or conservator is nominated by will and the will waives the bond requirement

- The court orders the ward’s assets to be deposited in a restricted account

Similar to a conservatorship, an individual who is no longer able to manage their business affairs because of age or disability can request the district court to appoint a curator to manage their financial affairs. Curators are required to purchase and maintain a surety bond if appointed.

How do Kentucky Conservators Become Appointed as Fiduciaries?

Conservators and guardians in Kentucky must navigate several steps to become appointed as fiduciaries. Below are the general guidelines, but appointees should refer to the appointment statutes for details on the process.

Step 1 – Hire an Attorney

Although not explicitly required, it is highly recommended that conservators or guardians hire an attorney to assist with the appointment process.

Step 2 – File a Petition for Appointment

Persons seeking conservatorship or guardianship over a proposed ward must file a petition for an appointment with the district court of the county where the proposed ward resides or has property. Conservators and guardians can obtain the necessary forms online here or from the district court, and must include the following information:

-

- Personal information of the proposed ward and their relatives

- Personal information about the person seeking the appointment

- General statement and evaluation of the proposed ward’s financial affairs

- The reasoning for why a conservatorship or guardianship is necessary

- Any additional information requested by the court

Conservators and guardians must also submit an application for appointment with the petition explaining the applicant’s relationship with the proposed ward and their qualifications to serve as a fiduciary. In cases involving a disabled adult, the court will order a medical doctor, a psychologist, and a social worker to evaluate the adult after the petition is filed. The medical professionals will submit a report to the court with their findings on whether guardianship or conservatorship is needed.

Step 3 – Attend a Hearing

Petitioners must attend a hearing conducted by the district court and present evidence as to why the proposed ward is in need of conservatorship or guardianship. The court will examine the evidence presented by the petitioner as well as that presented by the proposed ward being evaluated (if any) and make a determination as to whether or not a conservatorship or guardianship is necessary.

If the court finds a basis for the appointment, it will determine what type of fiduciary relationship is needed and issue a letter of conservatorship or guardianship to the petitioner.

Step 4 – Purchase a Surety Bond

Unless otherwise exempt, conservators and guardians must purchase and maintain a surety bond (limits outlined above).

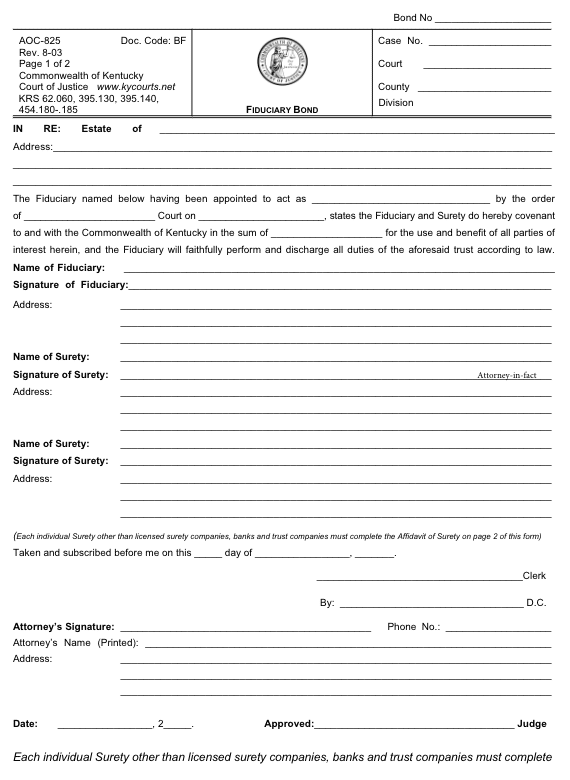

How do Kentucky Conservators File Their Bonds?

Conservators and guardians should submit their completed bond forms, including the power of attorney, to the district court of the county where the ward resides or has property.

The surety bond requires signatures from the company that issues the bond and the applicant. The surety company should include the following information on the bond form:

- Case number

- Legal name and address of the ward

- Legal name of the entity/individual(s) buying the bond

- Legal name, address, and phone number of the fiduciary’s attorney

- Surety company’s name and address

- Date the fiduciary is appointed

- Type of fiduciary relationship

- Date the bond is signed

- Bond amount

What can Kentucky Conservators do to Avoid Claims Made Against Their Bonds?

To avoid claims against their bonds, guardians and conservators in Kentucky must ensure that they:

- Perform all of their fiduciary duties

- Obey all court orders

- Do not mismanage the estate’s assets