Medicare Shared Savings Program Bond: A Comprehensive Guide

This guide provides information for insurance agents to help their customers obtain a Medicare Shared Savings Program bond

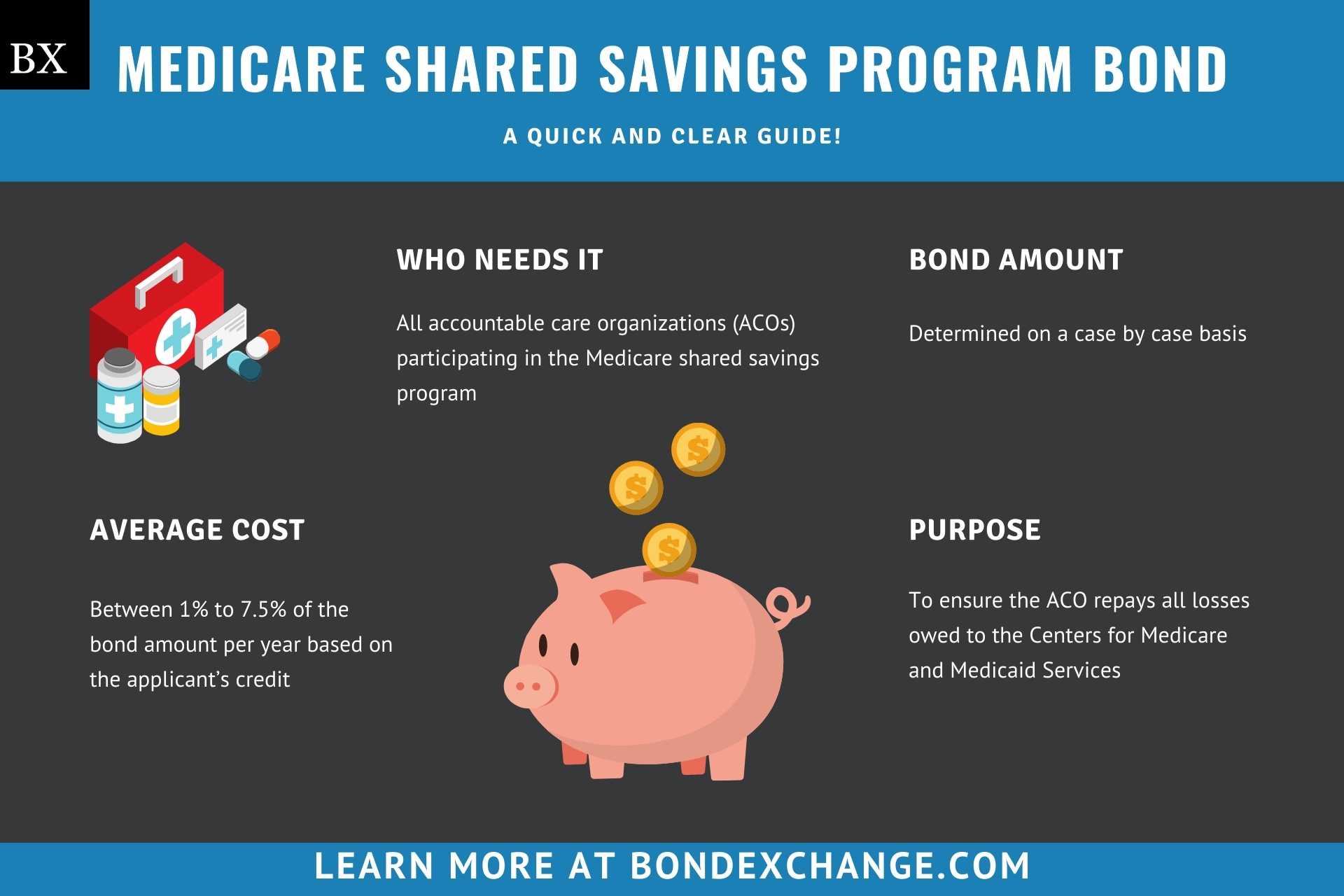

At a Glance:

- Lowest Cost: 1% of the bond amount per year based on the applicant’s credit

- Bond Amount: Determined on a case by case basis (more on this later)

- Who Needs it: All accountable care organizations (ACOs) participating in the Medicare shared savings program

- Purpose: To ensure the ACO repays all losses owed to the Centers for Medicare and Medicaid Services

- Who Regulates Accountable Care Organizations: The Centers for Medicare and Medicaid Services (CMS)

Background

Section 1899 of the Social Security Act aims to transition the American healthcare system away from a fee-for-service payment system towards one that is value-based through the creation of shared savings programs. These programs incentivize ACOs to provide high-quality care at reduced costs by rewarding them with a share of the total savings they generate. However, shared savings programs are not without risks, as ACOs that do not generate savings are liable to repay a portion of the losses sustained by CMS. To ensure that CMS does not suffer a financial loss if the ACO fails to generate savings, ACOs that participate under a 2-sided model must either purchase and maintain a surety bond, set up an escrow account, or obtain a letter of credit (or a combination of all three) before entering into a shared savings program agreement.

What is the Purpose of the Shared Savings Program Bond?

CMS requires ACOs to purchase a surety bond (or establish another type of repayment mechanism) as a prerequisite to participating in a 2-sided shared savings program. The bond ensures that CMS will receive compensation for financial harm if the ACO fails to comply with the regulations outlined in federal statute 425.204. Specifically, the bond protects CMS if the ACO fails to provide payments for losses that have been sustained under their shared savings program. In short, the bond is a type of insurance that protects CMS if the ACO doesn’t reimburse them for losses.

How Can an Insurance Agent Obtain a Medicare Shared Savings Program Surety Bond?

BondExchange makes obtaining a Medicare Shared Savings Program bond easy. Simply log in to your account and use our keyword search to find the “medicare” bond in our database. Don’t have a login? Gain access now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone at (800) 438-1162, email, or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

Not an agent? Then let us pair you with one!

Click the above image to find a BX Agent near you

How is the Bond Amount Determined?

Federal statue 425.204 dictates that the bond amount must be the lesser of the following:

- One percent of the total per capita Medicare Parts A (inpatient) and B (outpatient) fee-for-service (FFS) expenditures for the ACOs assigned beneficiaries, based on expenditures for the most recent calendar year for which 12 months of data are available

- Two percent of the total Medicare Parts A and B FFS revenue of the ACO participants, based on revenue for the most recent calendar year for which 12 months of data are available

The ACO is liable to repay all shared losses owed to CMS, even if those losses are greater than their bond’s limit. CMS will recalculate the ACOs required repayment amount annually

What are the Underwriting Requirements for the Medicare Shared Savings Program Bond?

Surety companies will examine consolidated business financial statements of the ACO’s parent organization. A credit report is usually not required for Medicare Shared Savings Program bonds, as these bonds act as a corporate, as opposed to individual, indemnity.

How Much Does the Medicare Shared Savings Program Bond Cost?

The Medicare Shared Savings Program bond can cost anywhere between 1% to 7.5% of the bond amount per year. BondExchange also offers monthly pay-as-you-go options for these bonds. Insurance companies determine the rate by examining your customer’s consolidated business financial statements. Submit an online application to obtain a quote for a Medicare Shared Savings Program bond.

BondExchange now offers monthly pay-as-you-go subscriptions for surety bonds. Your customers are able to purchase their bonds on a monthly basis and cancel them anytime. Learn more here.

Who is Required to Purchase the Bond?

CMS requires all accountable care organizations to purchase a surety bond, obtain a letter of credit, or establish an escrow account (or a combination of all three) before entering into a 2-sided model shared savings program agreement. To paraphrase federal statute 425.20, an accountable care organization is a legal entity that is comprised of one or more Medicare providers and attempts to give coordinated and high-quality care to Medicare patients.

ACOs can enter into either a 1-sided model or a 2-sided model for their shared savings program agreement. In a 1-sided model, the ACO does not assume any risk for losses the program incurs. However, their share of potential savings is greatly limited. Alternatively, 2-sided models require ACOs to repay CMS a certain percentage of the losses incurred, while also allowing them to keep a greater share of any savings. CMS requires ACOs participating in a 2-sided model to establish a repayment method to ensure the ACO repays them for a percentage of the losses the shared saving plan incurs.

How do ACOs Enter Into a Shared Savings Program Agreement?

ACOs must navigate several steps to enter into a shared savings program agreement. Below are the general guidelines, but applicants should refer to CMS’s application toolkit for details on the process.

Agreement Period – Shared savings programs must have an agreement period of a minimum of 5 years

Step 1 – Purchase a Surety Bond

ACOs must purchase and maintain a surety bond, obtain a letter of credit, or establish an escrow account with a limit that is the lessor of the following:

-

- One percent of the total per capita Medicare Parts A (inpatient) and B (outpatient) fee-for-service (FFS) expenditures for the ACOs assigned beneficiaries, based on expenditures for the most recent calendar year for which 12 months of data are available

- Two percent of the total Medicare Parts A and B FFS revenue of the ACO participants, based on revenue for the most recent calendar year for which 12 months of data are available

Step 2 – Complete the Application

New shared saving program agreements will typically start on January 1 of each year. However, ACOs must begin the application process far sooner, generally 6 months prior to their agreement’s start date. Below are the actions that ACOs must take during the application process. Keep in mind that CMS may change these requirements each year. ACOs can access CMS’s application steps and timeline page, which outlines submission dates for the upcoming performance year and contains sample applications, here.

2.a Submit a Notice of Intent to Apply (NOIA) through the ACO Management System (ACO-MS)

2.b Submit Phase 1 of the application through the ACO-MS. The following items must be submitted:

-

- ACO participant list

- SNF Affiliate List (if applicable)

- Sample agreements, executed agreements, and attestations

- Form CMS-588 Electronic Funds Transfer Authorization Agreement

- Repayment mechanism documentation

2.c Respond to the Phase 1 first request for information

-

- This is the last opportunity to add ACO affiliates and/or SNF Affiliates

2.d Respond to Phase 1 RFI-2

-

- This is the last opportunity to withdraw ACO participants and/or SNF affiliates

- ACOs will receive their required repayment mechanism (surety bond) amount

2.e ACO participant list and SNF affiliate list dispositions will take place

2.f Submit Phase 2 of the application through the ACO-MS. The following items must be submitted:

-

- Governing body and organizational chart

- SNF 3-Day Rule Waiver and/or BIP applications (if applicable)

2.g Respond to Phase 2 RFI

2.h Final application dispositions will take place

2.i ACO signing event will commence and the repayment method will be due

How Do ACOs Renew Their Shared Savings Program Agreement?

Shared savings programs must have an agreement period of a minimum of 5 years. CMS will send the ACO instructions on how to renew their agreement. Additionally, ACOs may submit a change request annually.

What are the Insurance Requirements for ACOs?

CMS does not require ACOs to obtain any form of liability insurance as a prerequisite to entering into a shared savings program agreement. However, individual providers may need insurance to obtain a business license or enroll as a Medicare provider. ACOs must purchase and maintain a surety bond, obtain a letter of credit, or establish an escrow account with a limit that is the lessor of the following:

- One percent of the total per capita Medicare Parts A (inpatient) and B (outpatient) fee-for-service (FFS) expenditures for the ACOs assigned beneficiaries, based on expenditures for the most recent calendar year for which 12 months of data are available

- Two percent of the total Medicare Parts A and B FFS revenue of the ACO participants, based on revenue for the most recent calendar year for which 12 months of data are available

How Do ACOs File Their Bond?

ACOs should mail their completed bond form, including the power of attorney, to the following address:

United States Department of Health and Human Services

7500 Security Blvd., Mail Stop C5-15-12,

Baltimore, MD 21244-185 0

The surety bond requires signatures from both the surety company that issues the bond and from a representative of the ACO. The surety company should include the following information on the bond form:

- Legal name of entity/individual(s) buying the bond

- Surety company’s name, address, and state of incorporation

- Bond amount

- Date the shared savings program agreement goes into effect

- Date the bond is signed

What Can ACOs Do to Avoid Claims Against Their Bonds?

To avoid claims made against their bonds, ACOs in must ensure that they repay all losses owed to CMS.

What Other Insurance Products Can Agents Offer ACOs?

CMS does not require ACOs to obtain any form of liability insurance as a prerequisite to entering into a shared savings program agreement. However, most individual providers will purchase insurance. Bonds are our only business at BondExchange, so we do not issue any other types of insurance, but our agents often utilize brokers for this specific line of business. A list of brokers in this space can be found here.

How Can Insurance Agents Prospect for ACO Customers?

CMS conveniently provides a list of active ACOs, which can be accessed here. Contact BondExchange for additional marketing resources. Agents can also leverage our print-mail relationships for discounted mailing services