North Dakota Auto Dealer Bond: A Comprehensive Guide

This guide provides information for insurance agents to help new and pre-owned car dealership owners on North Dakota Auto Dealer bonds

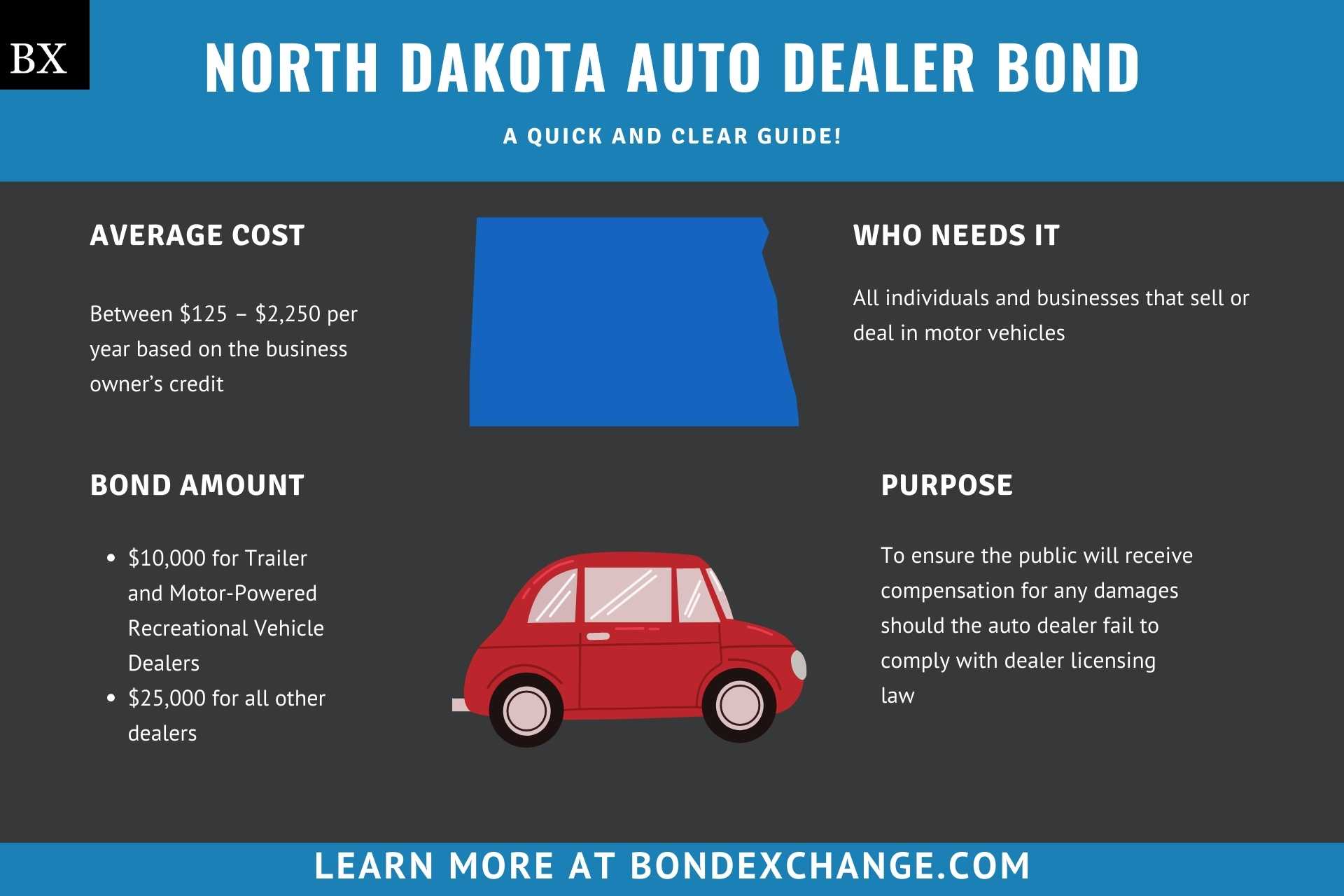

At a Glance:

- Average Cost: $100 per year or $10 per month, based on the business owner’s credit

- Bond Amount:

- $10,000 for Trailer and Motor-Powered Recreational Vehicle Dealers

- $25,000 for all other dealers

- Who Needs It: All individuals and businesses that sell or deal in motor vehicles

- Purpose: To ensure the public will receive compensation for any damages should the auto dealer fail to comply with dealer licensing law

- Who Regulates Dealers in North Dakota: The North Dakota Department of Transportation, Motor Vehicle Division (MVD)

Background

North Dakota Century Code 39-22 mandates auto dealers operating in the state to obtain a motor vehicle dealer license with the MVD. The North Dakota legislature enacted the license and regulations to ensure that dealers engage in ethical business practices and remit required taxes and fees. In order to provide financial security for the enforcement of the license law, dealers must purchase and maintain either a $25,000 or $10,000 motor vehicle dealer surety bond to be eligible for licensure.

What is the Purpose of the North Dakota Auto Dealer Bond?

North Dakota requires dealers to purchase the Motor Vehicle Dealer Bond as part of the application process for the Motor Vehicle Dealer License. The bond ensures that the public will receive compensation for financial harm if the auto dealer fails to comply with the licensing regulations and that the dealer will pay all required taxes and fees to the State of North Dakota. In short, the bond is a type of insurance that protects the public if the dealer breaks licensing laws.

How Can an Insurance Agent Obtain a North Dakota Auto Dealer Bond?

BondExchange makes obtaining a North Dakota Auto Dealer Bond easy. Simply login to your account and use our keyword search to find the “auto dealer” bond in our database. Don’t have a login? Gain access now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

Not an agent? Then let us pair you with one!

Click the above image to find a BX Agent near you

How Much Does the North Dakota Auto Dealer Bond Cost?

The $25,000 North Dakota Motor Vehicle Dealer surety bond can cost anywhere between $125 to $2,250 per year or $13 to $250 per month. Insurance companies determine the rate based on a number of factors including your customer’s credit score and experience. We also offer easy interest-free financing for premiums over $500. The chart below offers a quick reference for the approximate bond cost on the $25,000 bond requirement.

$25,000 North Dakota Auto Dealer Bond Cost

| Credit Score* | Bond Cost (1 year) | Bond Cost (1 month) |

|---|---|---|

| 699+ | $125 | $13 |

| 660 – 698 | $188 | $19 |

| 649 – 659 | $200 | $20 |

| 629 – 648 | $250 | $25 |

| 619 – 628 | $375 | $3 |

| 600 – 618 | $750 | $75 |

| 580 – 599 | $1,500 | $150 |

| 550 – 579 | $2,000 | $200 |

| 500 – 549 | $2,250 | $225 |

*The credit score ranges do not include other factors that may result in a change to the annual premium offered to your customers, including but not limited to, years of experience and underlying credit factors contained within the business owner’s credit report.

How Does North Dakota Define “Motor Vehicle Dealer”?

The North Dakota Dealer Handbook defines a motor vehicle dealer as anyone who buys, sells or exchanges motor vehicles either directly or indirectly.

BondExchange now offers monthly pay-as-you-go subscriptions for surety bonds. Your customers are able to purchase their bonds on a monthly basis and cancel them anytime. Learn more here.

How Do Dealers Apply for a Motor Vehicle Dealer License in North Dakota?

The process for applying for a motor vehicle dealer license in North Dakota is pretty complex. Below are the general guidelines, but dealers should refer to the North Dakota Dealer Handbook for details on the process.

License Period – The North Dakota Dealer License expires on December 31 each year regardless of the date of issuance and must be renewed before the expiration date.

Step 1 – Determine the License Type

North Dakota requires dealers to obtain specific licenses corresponding to the nature in which the dealer’s business operates. Keep in mind that dealers will need to acquire a license for each type of business they wish to operate. Below are the different types of the North Dakota dealer license.

-

- New Dealer – Sells new or used motor vehicles

- Used Dealer – Sells used motor vehicles only

- Motor Powered Recreational Vehicle Dealer – Sells recreational vehicles vehicles such as ATVs, UTVs, snowmobiles and other unconventional vehicles

- Trailer Dealer – Sells trailers

- Mobile Home Dealer – Sells mobile homes, manufactured homes, motorhomes and travel trailers

- Low Speed Dealer – While this license is not required by law, dealers can obtain a Low Speed Dealer license allowing them to receive low speed dealer plates if they submit an application and pay a $20 fee

Step 2 – Establish a Location

Dealers are required to establish a permanent place of business that meets the following minimum requirements:

-

- Enclosed building of at least 250 square feet that is owned or leased by the dealer and used solely for commercial purposes

- Have a primary display lot that is at least 2,500 square feet and adjacent to the office building

- Functioning heating and lighting systems as well as office space to store records

- Publicly listed telephone in the name of the business and be open during normal business hours

- Permanent sign identifying the dealership as a motor vehicle dealership. The sign must be at least 32 square feet in size, be clearly visible from the street and contain the name of the dealership in letters at least 10 inches high

- Failure to maintain these minimum standards will result in an initial fine of $100, followed by a $200 fine and then the dealer’s license will be suspended for a third violation.

Step 3 – Purchase a Surety Bond

Dealers must purchase and maintain a bond in the amount of $10,000 for Trailer and Motor-Powered Recreational Vehicle Dealers or $25,000 (most common) for all other licenses. While the license expires on December 31st of each year, the bond may be purchased for multiple years and does not need to run concurrently with the license period.

Step 4 – Obtain Insurance

Dealers must acquire comprehensive liability insurance (limits not specified) including continuous coverage of general, business automobile, sales, repair or service liability.

Step 5 – Complete the Application

Dealers can find the Dealer License Application Form here. All new dealer regulatory license applications and dealer regulatory license renewal applications should be mailed to:

Motor Vehicle Division

ND Dept of Transportation

608 E Boulevard Ave

Bismarck ND 28505-0780

-

- 5.a Dealer Plates – Dealers are allotted one initial dealer plate and can acquire additional dealer plates contingent on sales output defined in the below table:

| Annual Vehicles Sold | Dealer Plates Allowed |

|---|---|

| 1 – 7 | 0 |

| 8 – 12 | 2 |

| 13 – 25 | 4 |

| 26 – 49 | 6 |

| 50 – 100 | 12 |

| 101 – 150 | 20 |

| 151 or more | Unlimited |

-

- 5.b Franchise Agreement – Dealers selling new motor vehicles must submit a franchise agreement with their application authorizing them to sell each make and model of new motor vehicle

Step 6 – Pay Fees

The following fees are associated with obtaining the North Dakota Dealer License:

-

- New Dealer – $100 application fee, $100 initial inspection fee and a $20 fee per additional dealer plate

- Used Dealer – $100 application fee, $100 initial inspection fee and a $20 fee per additional dealer plate

- Motor Powered Recreational Vehicle Dealer – $25 application fee, $50 initial inspection fee and a $10 fee per additional dealer plate

- Trailer Dealer – $30 application fee, $100 initial inspection fee and $10 fee per additional dealer plate

Step 7 – Pass Inspection

The dealer must pass an inspection with the MVD ensuring the dealer’s business location is in compliance with the minimum requirements outlined in Step 2.

How Do North Dakota Auto Dealers Renew Their License?

The North Dakota Dealer License expires on December 31 each year regardless of the date of issuance and must be renewed before the expiration date. Dealers should mail the completed application form along with all applicable fees to the following address:

Motor Vehicle Division

ND Dept of Transportation

608 E Boulevard Ave

Bismarck ND 28505-0780

***Dealers who sell less than 8 motor vehicles a year will not be allowed to renew their license.***

What Are the Insurance Requirements for the North Dakota Auto Dealer License?

The State of North Dakota requires dealers to obtain comprehensive liability insurance (limits not specified). Dealers must file either a $25,000 or $10,000 motor vehicle dealer bond.

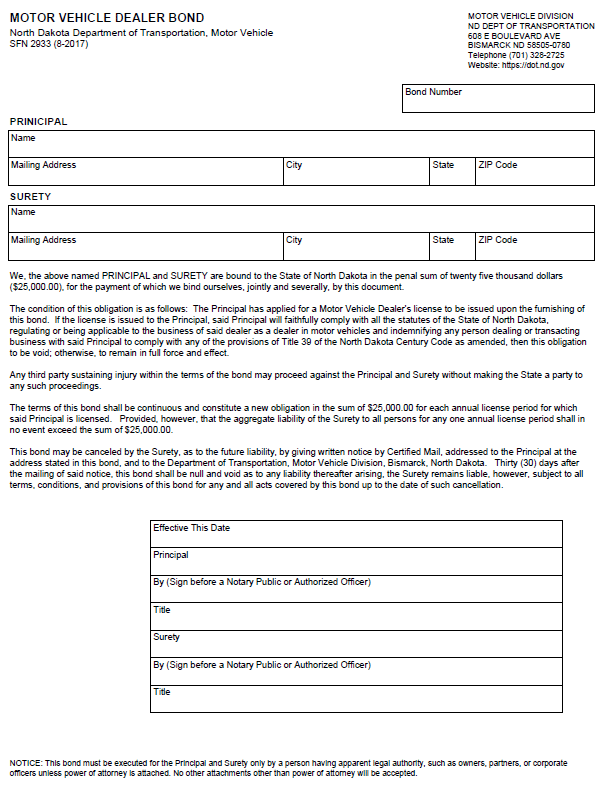

How Do North Dakota Auto Dealers File Their Bond?

The North Dakota motor vehicle dealer bond requires signatures from both the surety company that issues the bond and the auto dealer. A complete bond form will include the following information:

- Legal name of entity/individual(s) buying the bond

- Physical address where the business will operate

- Surety company’s name, address, phone number and signature

- Date the bond is signed

- Notary seal and signature for both the surety and principal

Dealers should mail the completed bond form, including the power of attorney, to the following address:

Motor Vehicle Division

ND Dept of Transportation

608 E Boulevard Ave

Bismarck ND 28505-0780

How Can North Dakota Auto Dealers Avoid Bond Claims?

To avoid claims on the Motor Vehicle Dealer Bond, dealers must follow all dealer regulations in the state, including some of the most important issues below that tend to cause claims:

- Do not engage, or allow representatives of the business to engage, in any acts of fraud

- Pay sellers of vehicles promptly and in full

- Transfer all vehicle titles when sold

- Pay taxes on time and in full. Dealers should consider setting aside tax obligations as they accrue.

- Do not engage in any illegal selling practices

What Other Insurance Products Can Agents Offer Dealers in North Dakota?

North Dakota requires dealers to obtain comprehensive liability insurance. Most reputable dealers that provide towing or service station services should also obtain garage keepers liability. Bonds are our only business at BondExchange, so we do not issue any form of liability insurance, but our agents often utilize brokers for this specific line of business. A list of brokers in this space can be found here.

How Can Insurance Agents Prospect for North Dakota Auto Dealer Customers?

North Dakota conveniently provides a public database to search for active motor vehicle dealers in the state. The database can be accessed on the MVD site here. Contact BondExchange for additional marketing resources. Agents can also leverage our print-mail relationships for discounted mailing services.

What Other States Require Auto Dealer Bonds?

All 50 states and the District of Columbia require auto dealers to obtain an Auto Dealer Bond as a prerequisite for licensure. Insurance agents should utilize our Main MVD Page for a detailed analysis of the Auto Dealer Bond requirements nationwide.