Ohio Auctioneer Bond: A Comprehensive Guide

Effective September 13, 2022, apprentice auctioneer and special auctioneer licenses will no longer be required. The Ohio legislature authored the licensing changes in House Bill 321. This page has been updated to reflect the change in licensure requirements.

This guide provides information for insurance agents to help their customers obtain an Ohio Auctioneer bond.

*Auctioneers in Ohio will need to maintain their surety bond for a period of three years. After the three-year period, auctioneers will be eligible to join the Auction Recovery Fund and have their bond requirement waived.

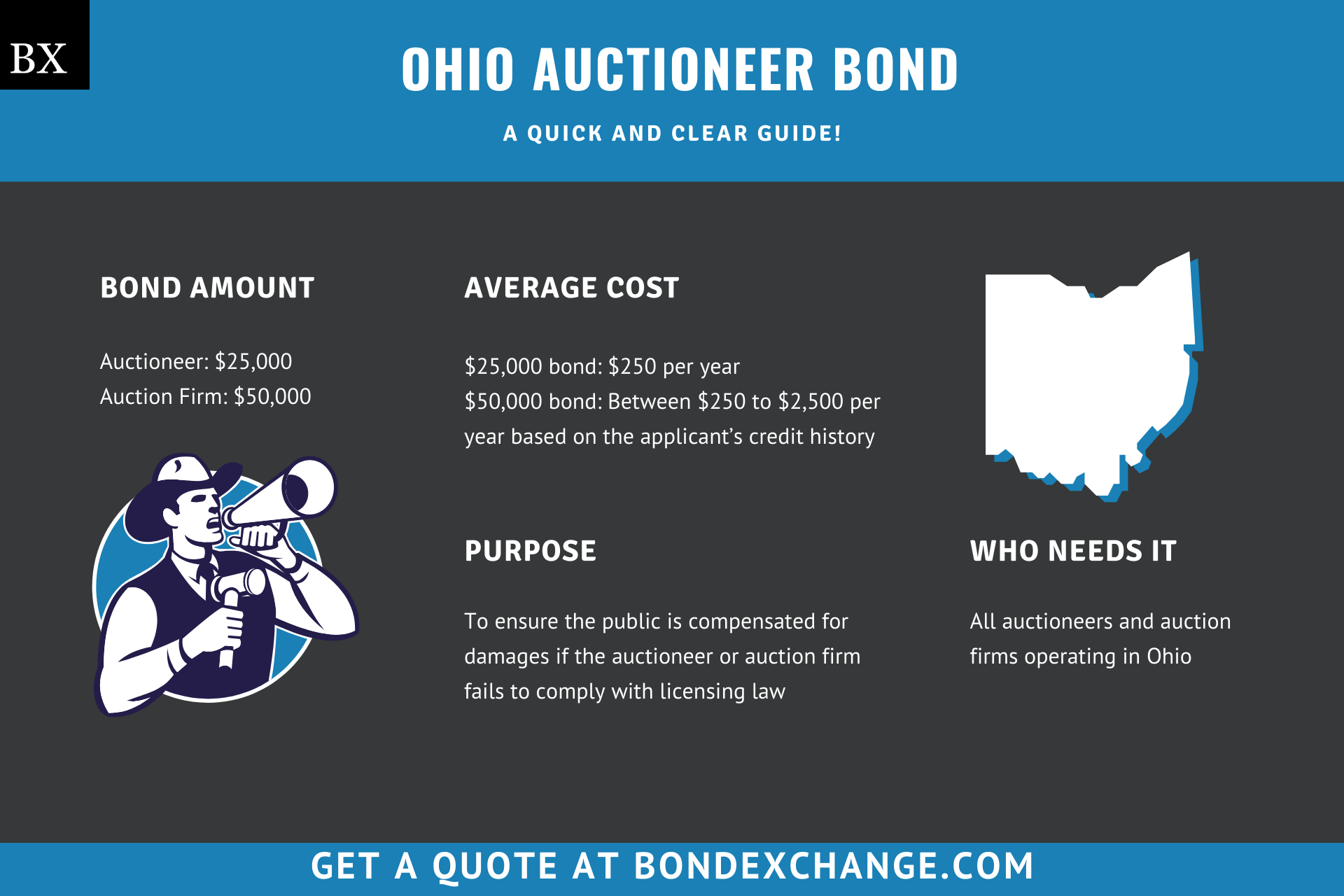

At a Glance:

- Lowest Cost: $250 per year or $25 per month

- Bond Amount: Based on license type

- Auctioneers: $25,000

- Auction Firms: $50,000

- Who Needs it: All auctioneers and auction firms operating in Ohio

- Purpose: To ensure the public is compensated for damages if the auctioneer fails to comply with licensing law

- Who Regulates Auctioneers in Ohio: The Ohio Department of Agriculture

Background

Ohio Code 4707.02 requires all auctioneers and auction firms operating in the state to obtain a license from the Department of Agriculture. The state legislature enacted the licensing laws and regulations to ensure that auctioneers engage in ethical business practices. To provide financial security for the enforcement of the licensing law, auctioneers must purchase and maintain a surety bond to be eligible for licensure.

What is the Purpose of the Ohio Auctioneer Bond?

Ohio requires auctioneers and auction firms to purchase a surety bond as part of the application process to obtain a business license. The bond protects the public from financial harm if the auctioneer fails to comply with the regulations set forth in Ohio Code 4707.11. Specifically, the bond protects the public from financial harm in the event the auctioneer commits fraud, does not maintain an accurate record of all transactions, or fails to accurately represent the goods up for sale. In short, the bond is a type of insurance that protects the public if the auctioneer or auction firm violates the terms of their license.

Auctioneers must maintain their bond for their first three years of licensure. If the auctioneer has not violated any part of Chapter 4707 of Ohio Code within those three years, the bond will no longer be required and the public will be protected under the state’s Auction Recovery Fund.

How Can an Insurance Agent Obtain an Ohio Auctioneer Surety Bond?

BondExchange makes obtaining an Ohio Auctioneer bond easy. Simply login to your account and use our keyword search to find the “Auctioneer” bond in our database. Don’t have a login? Gain access now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

Not an agent? Then let us pair you with one!

Click the above image to find a BX Agent near you

Is a Credit Check Required for the Ohio Auctioneer Bond?

There is no credit check required for the $25,000 bond Ohio Auctioneer bond. Because the bond is considered relatively low risk, the same low rate is offered to all auctioneers operating in the state regardless of their credit history.

However, surety companies will run a credit check on the auctioneer to determine eligibility and pricing for the $50,000 Ohio Auctioneer bond. Auctioneers with excellent credit and work experience can expect to receive the best rates. Auctioneers with poor credit may be declined by some surety companies or pay higher rates. The credit check is a “soft hit”, meaning that the credit check will not affect the auctioneers’ credit.

How Much Does the Ohio Auctioneer Bond Cost?

The $25,000 Ohio Auctioneer bond costs just $250 per year or $25 per month.

The $50,000 bond can cost anywhere between $250 to $2,500 per year or $25 to $250 per month. Insurance companies determine the rate based on several factors including your customer’s credit score and experience. The chart below offers a quick reference for the cost of the $50,000 bond requirement.

$50,000 Bond Cost

| Credit Score | Bond Cost (1 year) | Bond Cost (1 month) |

|---|---|---|

| 625+ | $250 | $25 |

| 600 – 624 | $750 | $75 |

| 550 – 599 | $1,250 | $125 |

| 525 – 549 | $1,500 | $150 |

| 500 – 524 | $2,500 | $250 |

*The credit score ranges do not include other factors that may result in a change to the annual premium offered to your customers, including but not limited to, years of experience and underlying credit factors contained within the business owner’s credit report.

Who is Required to Purchase the Bond?

Ohio requires auctioneers to purchase a surety bond as a prerequisite to obtaining a business license. To paraphrase Ohio Code 4707.01, an auctioneer is a person that sells property to the highest bidder at an auction. Likewise, an auction firm is a person who arranges, manages, or sponsors an auction of property, including auctions conducted online.

Exemptions to this requirement include:

- Auctioneers who received their license prior to July 1, 2003

- Licensed livestock dealers

- Licensed motor vehicle dealers

- Charitable or nonprofit organizations

- Individuals selling their own property

- Auctions conducted for educational purposes

- Sales made on behalf of the court or government

- Sales made at auctions required by law

- Auctions conducted by the champion of a national or international bid calling contest

BondExchange now offers monthly pay-as-you-go subscriptions for surety bonds. Your customers are able to purchase their bonds on a monthly basis and cancel them anytime. Learn more here.

How Do Auctioneers Apply for a License in Ohio?

Auctioneers in Ohio must navigate several steps to secure their licenses. Below are the general guidelines, but applicants should refer to the Ohio Auctioneer Guidebook and the Department of Agriculture’s licensing page for details on the process.

License Period – All Ohio Auctioneer and Auction Firm Licenses expire on June 30 of every other year based on the licensee’s last name or business name.

- Odd numbered years (2023, 2025, etc.) for applicants with names beginning with A through J

- Even numbered years (2022, 2024, etc.) for applicants with names beginning with K through W

Auctioneers

Step 1 – Meet the Experience Requirements

To become a licensed auctioneer in Ohio, applicants must ensure that they satisfy all of the following criteria:

-

- Be at least 18 years old

- Graduate from an approved auctioneering school

Step 2 – Purchase a Surety Bond

Auctioneers are required to purchase and maintain a $25,000 surety bond.

Step 3 – Complete the Application

All Ohio Auctioneer License applications should be submitted online here. Auctioneers must complete the application in its entirety, and submit the following items:

-

- Surety Bond

- Police Waiver form

- 12 Certification of Participation in Auction forms signed by the applicant’s sponsor

- Proof of graduation at an approved auction school

- Examination and prorated licensing fee

- If applying at the beginning of the license term, $228.50

- If applying halfway through the license term, $103.50

Step 4 – Pass the Exams

Applicants are required to pass both an oral and written exam administered by the Department of Agriculture before being issued their license. After reviewing their application, the department will contact the applicant and provide them with instructions on how to schedule an exam.

Auction Firms

Step 1 – Designate a Firm Manager

Auction firms are required to designate a firm manager who is responsible for ensuring the auction firm complies with all applicable laws and rules. The firm manager must be someone with a sufficient amount of authority in running the day to day operations of the business.

Step 2 – Purchase a Surety Bond

Auction firms are required to purchase and maintain a $50,000 surety bond.

Step 3 – Complete the Application

All Ohio Auction Firm License applications should be submitted online here. Firms must complete the application in its entirety, and submit the following items:

-

- List of names of all owners, directors, partners, or members

- Registered business name

- Physical business location and location of auction records

- $118.50 licensing and examination fee

Step 4 – Pass the Exam

Auction firm managers that are not licensed auctioneers must pass a written exam administered by the Department of Agriculture before the firm can receive their license. After reviewing their application, the department will contact the firm and notify them of their manager’s exam date.

How do Ohio Auctioneers Renew Their Licenses?

Prior to the expiration date, the Department of Agriculture will send the auctioneer a renewal notice containing instructions on how to renew their license. Auctioneers and auction firms are required to submit proof of completion of eight hours of continuing education with their renewal application. All renewals submitted after July 1 will be subject to a $100 late fee, and all renewals submitted after September 1 will have to re-do the initial licensure process.

What are the Insurance Requirements for Auctioneers in Ohio?

Ohio does not require auctioneers to purchase any form of liability insurance as a prerequisite to obtaining a state license. Auctioneers and auction firms must purchase and maintain a surety bond with the following limits:

- $25,000 bond: Required for auctioneers

- $50,000 bond: Required for auction firms

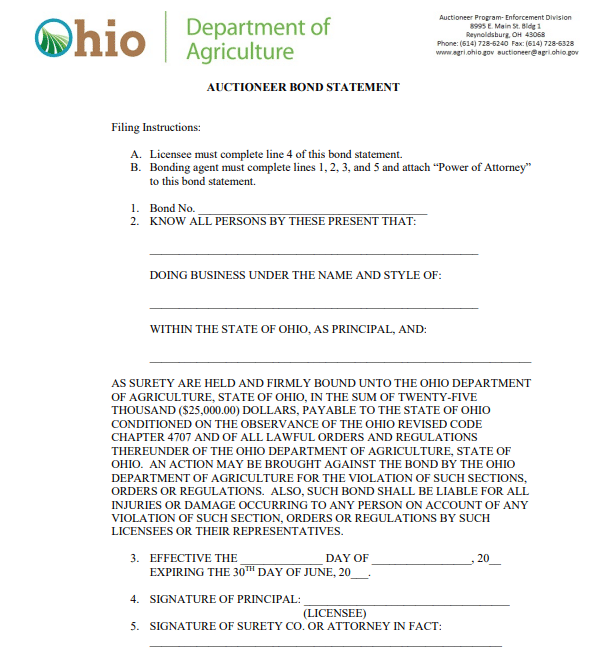

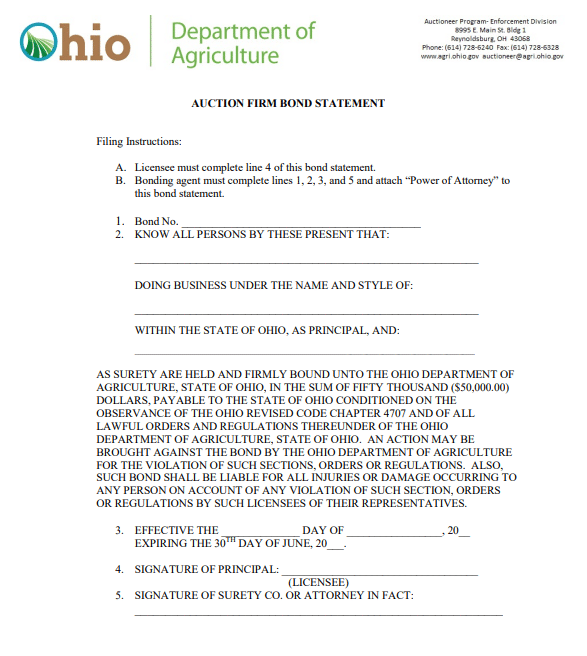

How Do Ohio Auctioneers File Their Bonds?

Auctioneers and auction firms should mail or deliver their completed bond forms, including the power of attorney, to the following address:

Ohio Department of Agriculture

Auctioneer Program

8995 East Main St

Reynoldsburg, OH 43068

The bond requires signatures from both the surety company that issues the bond and the applicant. The surety company should include the following information on the bond form:

- Legal name of the entity/individual(s) buying the bond

- Surety company’s name

- Dates the bond goes into effect and expires

What Can Ohio Auctioneers do to Avoid Claims Made Against Their Bonds?

To avoid claims on their bonds, auctioneers in Ohio must follow all license regulations in the state, including some of the most important issues below that tend to cause claims:

- Do not engage in any acts of fraud

- Maintain an accurate record of all transactions

- Accurately represent all goods up for sale

- Provide all goods that have been paid for

What Other Insurance Products Can Agents Offer Auctioneers in Ohio?

Ohio does not require auctioneers to purchase any form of liability insurance as a prerequisite to obtaining a state license. However, most reputable auctioneers will purchase liability insurance. Bonds are our only business at BondExchange, so we do not issue any other types of insurance, but our agents often utilize brokers for this specific line of business. A list of brokers in this space can be found here.

How Can Insurance Agents Prospect for Ohio Auctioneer Customers?

Ohio conveniently provides a public database to search for active auctioneers and auction firms in the state. Contact BondExchange for additional marketing resources. Agents can also leverage our print-mail relationships for discounted mailing services.