South Carolina Money Transmitter Bond: A Comprehensive Guide

This guide provides information for insurance agents to help their customers obtain South Carolina Money Transmitter Bonds

At a Glance:

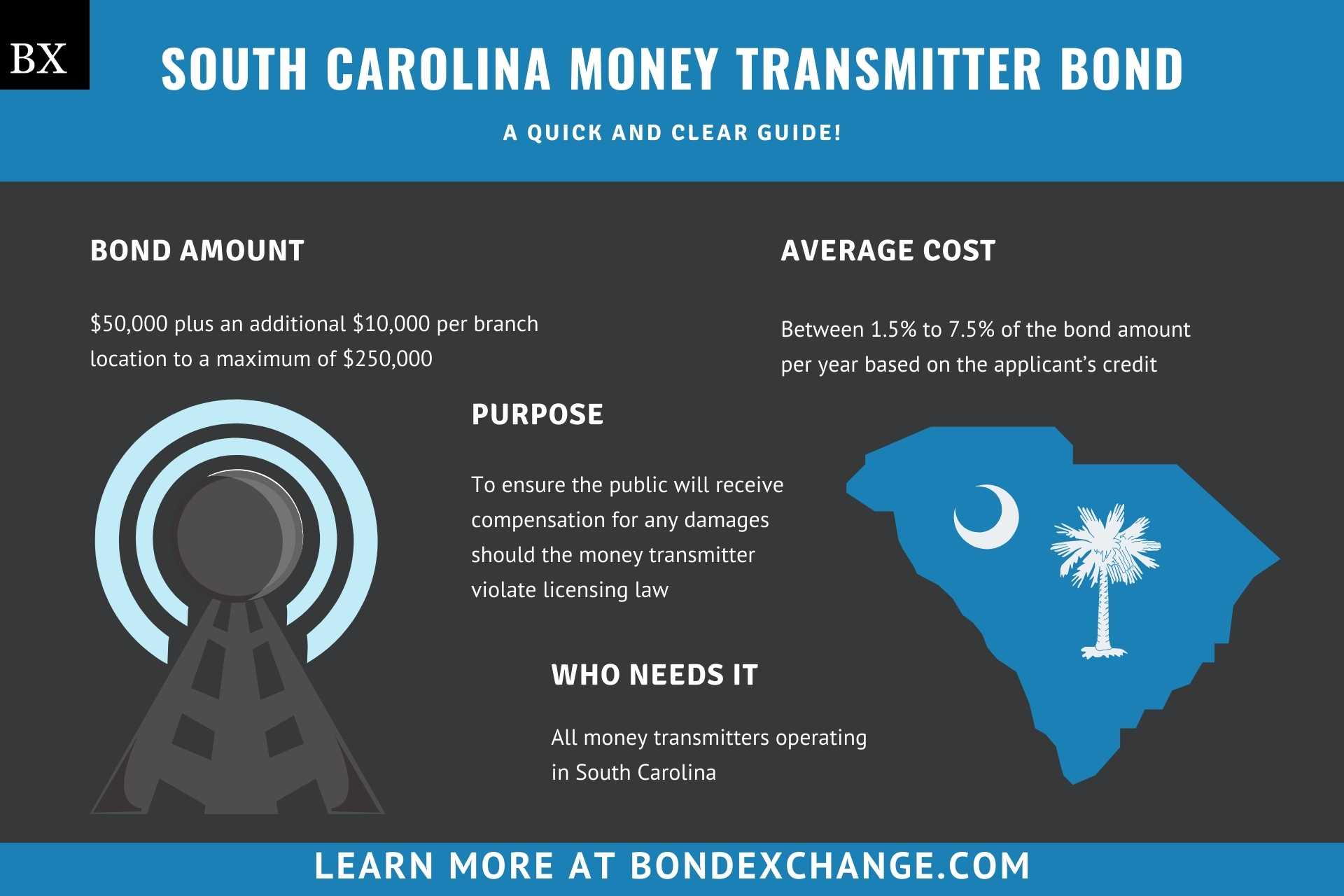

- Lowest Cost: 1.5% of the bond amount per year based on the applicant’s credit

- Bond Amount: $50,000 plus an additional $10,000 per branch location to a maximum of $250,000

- Who Needs it: All money transmitters operating in South Carolina

- Purpose: To ensure the public will receive compensation for any damages should the money transmitter violate licensing law

- Who Regulates Money Transmitters In South Carolina: The South Carolina Office of the Attorney General

Background

South Carolina statute 35-11-200 requires all money transmitters operating in the state to obtain a license with the Office of the Attorney General. The South Carolina legislature enacted the licensing laws and regulations to ensure that money transmitters engage in ethical business practices. In order to provide financial security for the enforcement of the licensing law, money transmitters must purchase and maintain a surety bond to be eligible for licensure.

What is the Purpose of the South Carolina Money Transmitter Bond?

South Carolina requires money transmitters to purchase a surety bond as part of the application process to obtain a business license. The bond ensures that the public will receive compensation for financial harm if the money transmitter fails to comply with the regulations set forth in the South Carolina Anti-Money Laundering Act. Specifically, the bond protects the public in the event the money transmitter engages in any acts of fraud or fails to transmit funds owed to consumers. In short, the bond is a type of insurance that protects the public if the money transmitter breaks licensing laws.

How Can an Insurance Agent Obtain a South Carolina Money Transmitter Surety Bond?

BondExchange makes obtaining a South Carolina Money Transmitter Bond easy. Simply login to your account and use our keyword search to find the “money” bond in our database. Don’t have a login? Gain access now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

Not an agent? Then let us pair you with one!

Click the above image to find a BX Agent near you

Is a Credit Check Required for the South Carolina Money Transmitter Bond?

Surety companies will run a credit check on the owners of the money transmission company to determine eligibility and pricing for the South Carolina Money Transmitter bond. Owners with excellent credit and work experience can expect to receive the best rates. Owners with poor credit may be declined by some surety companies or pay higher rates. The credit check is a “soft hit”, meaning that the credit check will not affect the owner’s credit.

How Much Does the South Carolina Money Transmitter Bond Cost?

The South Carolina Money Transmitter Bond can cost anywhere between 1.5% to 7.5% of the bond amount per year. Insurance companies determine the rate based on a number of factors including your customer’s credit score and experience. The chart below offers a quick reference for the approximate bond cost on a $50,000 bond requirement.

$50,000 Money Transmitter Bond Cost

| Credit Score | Bond Cost (1 year) | Bond Cost (1 month) |

|---|---|---|

| 800+ | $750 | $75 |

| 650 – 799 | $1,000 | $100 |

| 600 – 649 | $2,000 | $200 |

| 550 – 599 | $3,750 | $375 |

How Does South Carolina Define “Money Transmitter?”

South Carolina statute 35-11-105 defines a money transmitter as any business entity who sells or issues payment instruments, stored value, or who receives money for transmission.

BondExchange now offers monthly pay-as-you-go subscriptions for surety bonds. Your customers are able to purchase their bonds on a monthly basis and cancel them anytime. Learn more here.

How Do Money Transmitters Apply for a License in South Carolina

Money transmitters in South Carolina must navigate several steps to secure their license. Below are the general guidelines, but applicants should refer to the NMLS’s application guidelines for details on the process.

License Period – The South Carolina Money Transmitter License expires on December 31 of each year and must be renewed before the expiration date

Step 1 – Purchase a Surety Bond

Money transmitters must purchase and maintain a surety bond with a limit of $50,000, plus an additional $10,000 per office location to a maximum of $250,000

Step 2 – Meet the Net Worth Requirements

Applicants for the South Carolina Money Transmitter License must have a minimum company net worth (assets – liabilities) of at least $250,000. Applicants must submit audited financial statements, prepared by a CPA, verifying their net worth when submitting their license application.

Step 3 – Request a NMLS Account

The South Carolina Money Transmitter License application is submitted electronically through the Nationwide Multistate Licensing System (NMLS). To submit a license application, applicants must first request to obtain an NMLS account.

Step 4 – Complete the Application

All South Carolina Money Transmitter License applications can be completed online through the NMLS. Applicants must complete the entire application, and submit the following items:

-

- Audited company financial statements indicating a net worth of at least $250,000

- Locations of all company authorized delegates

- Primary company and consumer complaint contact information

- Company’s FinCEN confirmation number and filing date

- Information on all company clearing bank accounts used to pay the company’s payment instruments and stored value

- Disclosure questions

- Company’s independently reviewed AML/BSA policy

- Company business plan containing the following information:

- Marketing strategies

- Products and services

- Target markets

- Fee schedule

- Operating structure

- Use of authorized delegates and additional locations

- Certificate of good standing

- The following document samples:

- Contract used with authorized delegates

- Screening process and documents used when selecting authorized delegates

- Payment instruments used

- Gramm-Leach-Bliley privacy notice

- Flow of funds structure

- Company formation documents

- Company management and organizational charts

- List of the company’s permissible investments

- Financial statements of the parent company (if a wholly owned subsidiary)

Money transmitters must pay the following fees when submitting their license application:

-

- $750 license fee

- $1,500 application fee

- $36.25 background check fee (per person)

- $15 credit report fee (per person)

- Annual $0.25 fee per authorized delegate (companies with 100 delegates or less are exempt)

How Do South Carolina Money Transmitters Renew Their License?

Money transmitters can renew their license online through the NMLS. License holders need to simply login to their account to access their renewal application. The South Carolina Money Transmitter License expires on December 31 of each year and must be renewed before the expiration date.

What Are the Insurance Requirements for the South Carolina Money Transmitter License?

South Carolina does not require money transmitters to purchase any form of liability insurance as a prerequisite to obtaining a business license. Money transmitters must purchase and maintain a surety bond with a limit of $50,000, plus an additional $10,000 per office location to a maximum of $250,000.

How Do South Carolina Money Transmitters File Their Bond?

Money transmitters should submit the completed bond form, including the power of attorney, electronically through the NMLS. The surety bond requires signatures from both the surety company that issues the bond and a representative from the money transmission company. The surety company should include the following information on the bond form:

- Name and NMLS number of entity/individual(s) buying the bond

- Surety company’s name and NAIC number

- Bond amount

- Date the bond is signed

What Can South Carolina Money Transmitters Do to Avoid Claims Against Their Bond?

To avoid claims on their bond, money transmitters in South Carolina must ensure that they follow all license regulations in the state, including some of the most important issues below that tend to cause claims:

- Do not engage in any acts of fraud

- Transmit all funds owed to consumers

What Other Insurance Products Can Agents Offer Money Transmitters in South Carolina?

South Carolina does not require money transmitters to purchase any form of liability insurance as a prerequisite to obtaining a business license. However, most reputable businesses will seek to obtain this insurance anyway. Bonds are our only business at BondExchange, so we do not issue other types of insurance, but our agents often utilize brokers for this specific line of business. A list of brokers in this space can be found here.

How Can Insurance Agents Prospect for South Carolina Money Transmitter Customers?

The NMLS conveniently provides a public database to search for active money transmitters in South Carolina. The database can be accessed here. Contact BondExchange for additional marketing resources. Agents can also leverage our print-mail relationships for discounted mailing services.