South Carolina Utility Deposit Bond: A Comprehensive Guide

This guide provides information for insurance agents to help their customers obtain a South Carolina Utility Deposit bond.

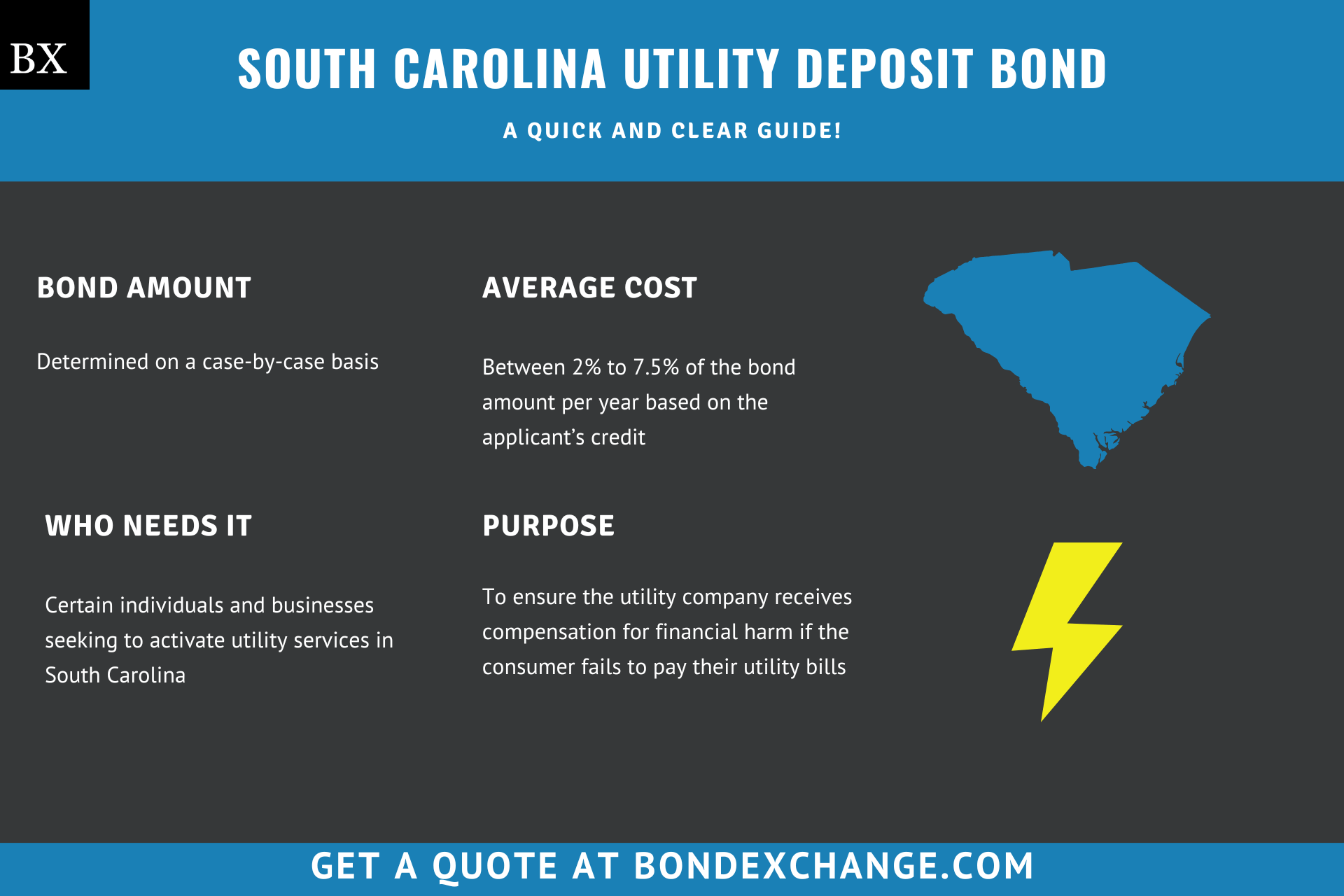

At a Glance:

- Average Cost: Between 2% to 7.5% of the bond amount per year based on the applicant’s credit

- Bond Amount: Determined on a case-by-case basis

- Who Needs it: Certain individuals and businesses that do not want to pay a cash deposit before receiving utility services

- Purpose: To ensure utility companies receive compensation for financial harm if the customer fails to pay their utility bills

- Who Requires Utility Deposit Bonds in South Carolina: Utility companies that provide services to the general public

Background

Utility companies in South Carolina often require customers expected to generate large monthly bills to pay a security deposit before initiating service. The security deposit protects utility companies from losses if the consumer fails to pay their monthly bills on time and in full. However, certain utility companies in South Carolina allow customers to purchase and maintain a surety bond in lieu of depositing cash. Unlike most surety bonds, utility deposit bonds are not required by a government agency but by the utility company providing the service (unless a municipality owns the utility company).

What is the Purpose of the South Carolina Utility Deposit Bond?

Certain utility companies in South Carolina require consumers that do not wish to pay a security deposit to purchase a surety bond as a prerequisite to obtaining utility services. The bond ensures that the utility company will receive compensation for financial harm if the consumer fails to comply with the provisions laid out in the bond form. Specifically, the bond protects the utility company if the consumer does not pay their monthly bills. In short, the bond is a type of insurance that protects utility companies if the consumer fails to remit all required payments.

How Can an Insurance Agent Obtain a South Carolina Utility Deposit Surety Bond?

BondExchange makes obtaining a South Carolina Utility Deposit Surety Bond easy. Simply login to your account and use our keyword search to find the “utility” bond in our database. Don’t have a login? Gain access now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email, or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

Not an agent? Then let us pair you with one!

Click the above image to find a BX Agent near you

Is a Credit Check Required for the South Carolina Utility Deposit Bond?

Surety companies will run a credit check on the applicant to determine eligibility and pricing for the South Carolina Utility Deposit bond. Applicants with excellent credit and work experience can expect to receive the best rates. Applicants with poor credit may be declined by some surety companies or pay higher rates. The credit check is a “soft hit”, meaning that the credit check will not affect the applicant’s credit.

How Much Does the South Carolina Utility Deposit Bond Cost?

A South Carolina Utility Deposit bond can cost anywhere between 2% to 7.5% of the bond amount per year. Insurance companies determine the rate based on a number of factors, including your customer’s credit score and experience. The chart below offers a quick reference for the approximate bond cost on a $10,000 bond requirement.

$10,000 Utility Deposit Bond Cost

| Credit Score* | Bond Cost (1 year) | Bond Cost (1 month) |

|---|---|---|

| 800+ | $200 | $20 |

| 650 – 799 | $500 | $50 |

| 600 – 649 | $750 | $75 |

*The credit score ranges do not include other factors that may result in a change to the annual premium offered to your customers, including but not limited to, years of experience and underlying credit factors contained within the business owner’s credit report.

BondExchange now offers monthly pay-as-you-go subscriptions for surety bonds. Your customers are able to purchase their bonds on a monthly basis and cancel them anytime. Learn more here.

Which Companies Allow Utility Deposit Bonds in South Carolina?

The following South Carolina utility companies allow customers to purchase a surety bond in lieu of depositing cash:

Aiken Electric Cooperative

Residential, poultry, and commercial customers may opt to purchase a surety bond in lieu of depositing cash. The required bond amount for residential and poultry customers is determined by the cooperative on a case-by-case basis. For commercial customers, the bond amount must equal the location’s two highest consecutive bills (estimated for new constructions).

Agents can contact Aiken Electric Cooperative here.

Berkeley Electric Cooperative

High-use customers can purchase a surety bond instead of depositing cash. The bond amount is determined on a case-by-case basis. However, all deposits must be a minimum of $250 for residential customers and $500 for commercial customers.

Agents can contact Berkely Electric Cooperative here.

Dominion Energy South Carolina

Commercial customers are required to either purchase a surety bond or deposit cash before initiating service. The bond amount must equal the two highest consecutive monthly bills at the location during a 24-month period. If the location is a new construction, the bond amount is determined based on the location’s square footage.

Agents can contact Dominion Energy South Carolina here.

Duke Energy

Commercial customers must either purchase a surety bond or deposit cash. The bond amount is determined on a case-by-case basis based on the customer’s estimated usage.

Agents can contact Duke Energy here.

Easley Combined Utilities

Commercial customers are required to either purchase a surety bond or deposit cash in an amount equal to twice the location’s estimated monthly bill.

Agents can contact Easly Combined Utilities here.

Orangeburg Department of Public Utilities

Commercial customers can choose to purchase a surety bond in lieu of depositing cash. The bond amount must equal two months of estimated billing (as determined by the department).

Agents can contact the Orangeburg Department of Public Utilities here.

Greenwood Commissioners of Public Works (CPW)

High-use customers are able to purchase a surety bond instead of depositing cash. The bond amount is determined on a case-by-case basis based on the customer’s estimated usage.

Agents can contact Greenwood CPW here.

Palmetto Electric Cooperative

Commercial customers must either purchase a surety or deposit cash before initiating service. The bond amount must equal twice the location’s actual or estimated average monthly bill.

Agents can contact Palmetto Electric Cooperative here.

Rock Hill Utilities

High-use customers can choose to purchase a surety bond instead of depositing cash. The bond amount is determined on a case-by-case basis based on the customer’s estimated usage.

Agents can contact Rock Hill Utilities here.

How Do South Carolina Utility Customers File Their Bonds?

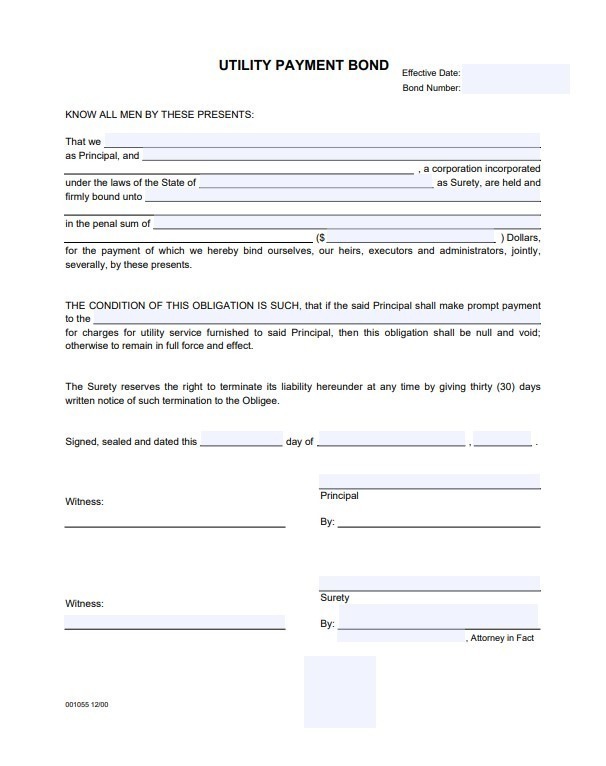

Utility customers in South Carolina should submit their completed bond forms, including the power of attorney, to the company requiring the bond. The surety bond requires signatures from both the surety company that issues the bond and from the customer. In some instances, the bond will require witness signatures as well. Generally, the surety company will include the following information on the bond form:

- Name and address of entity/individual(s) buying the bond

- Surety company’s name and address

- Entity requiring the bond

- Bond amount

- Date the bond is signed

- Date the bond goes into effect

What Can Utility Customers in South Carolina Do to Avoid Claims Against Their Bonds?

To avoid claims on their bonds, utility customers in South Carolina must ensure they pay their utility bills on time and in full.

What Other Insurance Products Can Agents Offer Utility Customers in South Carolina?

Utility companies generally only require businesses to be bonded. As such, agents can offer their customers general business and liability insurance in addition to the utility deposit bond. Bonds are our only business at BondExchange, so we do not issue liability insurance, but our agents often utilize brokers for this specific line of business. A list of brokers in this space can be found here.

Should Your Customer Purchase a Surety Bond or Deposit Cash?

Surety bonds are generally considered the better option for businesses, as they free up working capital that would otherwise have to be deposited with the utility company. For more information on whether your customer should purchase a bond or deposit cash, check out our Surety Bonds vs. Letters of Credit article here.