U.S. Bankruptcy Court Auctioneer Bond: A Comprehensive Guide

This guide provides information for insurance agents to help their customers obtain a U.S. Bankruptcy Court Auctioneer bond.

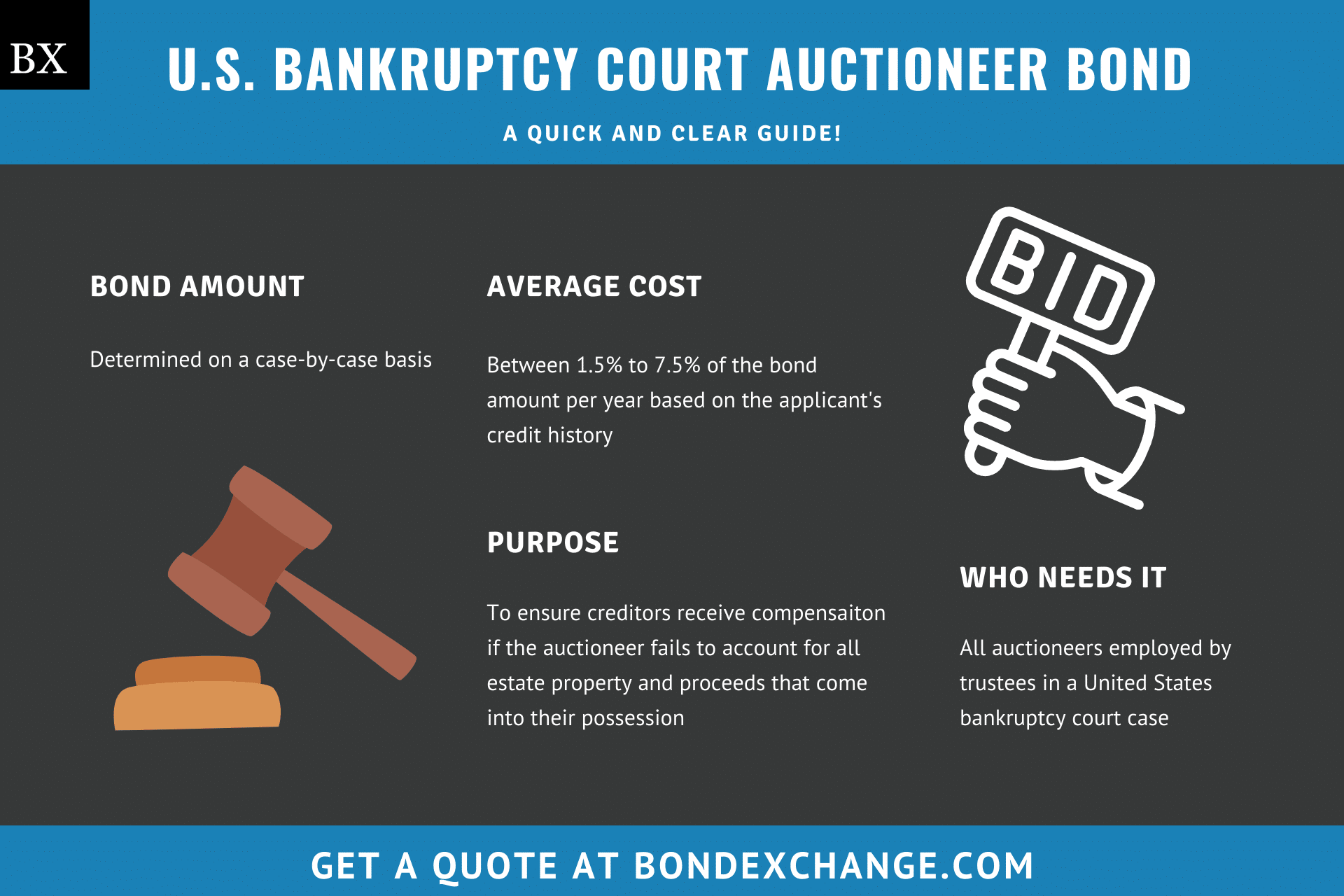

At a Glance:

- Average Cost: Between 1.5% to 7.5% of the bond amount per year based on the applicant’s credit history

- Bond Amount: Determined on a case-by-case basis (more on this later)

- Who Needs it: All auctioneers employed by trustees in a United States bankruptcy court case

- Purpose: To ensure creditors receive compensation if the auctioneer fails to account for all estate property and proceeds that come into their possession

- Who Regulates Bankruptcy Auctioneers: The U.S. Department of Justice

Background

11 U.S. Code 327 permits persons selected to serve as a trustee in a U.S. bankruptcy court case to hire an auctioneer to assist them in liquidating an estate’s assets. The United States Congress authored this statute to ensure that trustees in bankruptcy cases are able to adequately perform their duties with the help of qualified professionals. To ensure that the estate’s creditors are protected against potential misdeeds, auctioneers must purchase and obtain a surety bond as a condition of employment.

*Important Note: Most states require auctioneers to purchase a surety bond as a prerequisite to obtaining a business license. Auctioneers employed by trustees must purchase the U.S. Bankruptcy Court Auctioneer bond in addition to their business license bond.

What is the Purpose of the U.S. Bankruptcy Court Auctioneer Bond?

Auctioneers are required to purchase a surety bond as a prerequisite to being hired by the trustee of a U.S. bankruptcy court case to liquidate the estate’s assets. The bond ensures that the estate’s creditors will receive compensation for financial harm if the trustee fails to comply with the regulations outlined on page 8-27 of the DOJ Handbook for Chapter 7 Trustees. Specifically, the bond protects creditors if the auctioneer fails to comply with all court orders or does not account for all property and proceeds that come into their possession. In short, the bond is a type of insurance that protects creditors if the auctioneer fails to faithfully perform their duties.

How Can an Insurance Agent Obtain an U.S. Bankruptcy Court Auctioneer Surety Bond?

BondExchange makes obtaining a U.S. Bankruptcy Court Auctioneer bond easy. Simply login to your account and use our keyword search to find the “Auctioneer” bond in our database. Don’t have a login? Gain access now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

Not an agent? Then let us pair you with one!

Click the above image to find a BX Agent near you

How is the Bond Amount Determined?

Page 8-27 of the DOJ Handbook for Chapter 7 Trustees dictates that the bond amount must be established by local bankruptcy rule or the U.S. trustee and be sufficient to cover the proceeds generated from the sale of the estate’s assets. Auctioneers that perform auctions for multiple estates in separate bankruptcy cases must ensure that their bond amount is sufficient to cover the proceeds generated from all future sales as well.

Is a Credit Check Required for the U.S. Bankruptcy Court Auctioneer Bond?

Surety companies will run a credit check on the auctioneer to determine eligibility and pricing for the U.S. Bankruptcy Court Auctioneer bond. Auctioneers with excellent credit and work experience can expect to receive the best rates. Auctioneers with poor credit may be declined by some surety companies or pay higher rates. The credit check is a “soft hit”, meaning that the credit check will not affect the auctioneer’s credit.

How Much Does the U.S. Bankruptcy Court Auctioneer Bond Cost?

The U.S. Bankruptcy Court Auctioneer bond can cost anywhere between 1.5% to 7.5% of the bond amount per year. Insurance companies determine the rate based on a number of factors including your customer’s credit score and years of experience.

The chart below offers a quick reference for the approximate bond cost of a $50,000 bond requirement.

| Credit Score | Bond Cost (1 year) | Bond Cost (1 month) |

|---|---|---|

| 800+ | $750 | $75 |

| 680 – 799 | $1,000 | $100 |

| 650 – 679 | $1,250 | $125 |

| 600 – 649 | $2,000 | $200 |

| 550 – 599 | $3,750 | $375 |

Who is Required to Purchase the U.S. Bankruptcy Court Auctioneer Bond?

Auctioneers are required to purchase a surety bond as a prerequisite to being employed by a trustee of a U.S. bankruptcy court case. An auctioneer is defined as a person that sells property to the highest bidder at auction.

BondExchange now offers monthly pay-as-you-go subscriptions for surety bonds. Your customers are able to purchase their bonds on a monthly basis and cancel them anytime. Learn more here.

What are the Requirements for Auctioneers Seeking Employment Related to Bankruptcy Cases?

Several steps must be taken before an auctioneer is eligible to participate in auctions relating to bankruptcy cases. Below are the general guidelines, but auctioneers should refer to the DOJ Handbook for Chapter 7 Trustees for details on the process.

Step 1 – Complete an Employment Application

The trustee must submit an employment application to the court overseeing the bankruptcy case as well as the United States Trustee (or their authorized representative) with jurisdiction over the estate. The application must include the following information:

-

- The specific facts necessitating employment

- The name of the person employed

- The reasons for selecting the firm or individual

- The professional services to be rendered

- The proposed arrangements for compensation

- The professional’s connections with the trustee, debtor, creditors, and other interested parties

Bankruptcy auctioneers must submit a verified statement stating their connections with the debtor, creditors, the trustee, or any other parties of interest. After reviewing the application, the court will either approve or deny the auctioneer’s employment.

Step 2 – Purchase a Surety Bond

After being approved, auctioneers must purchase and maintain a surety bond (limits outlined above).

What are the Insurance Requirements for Bankruptcy Auctioneers?

Trustees may require auctioneers to purchase insurance for lost or stolen property. Auctioneers in bankruptcy cases must purchase and maintain a surety bond (limits outlined above).

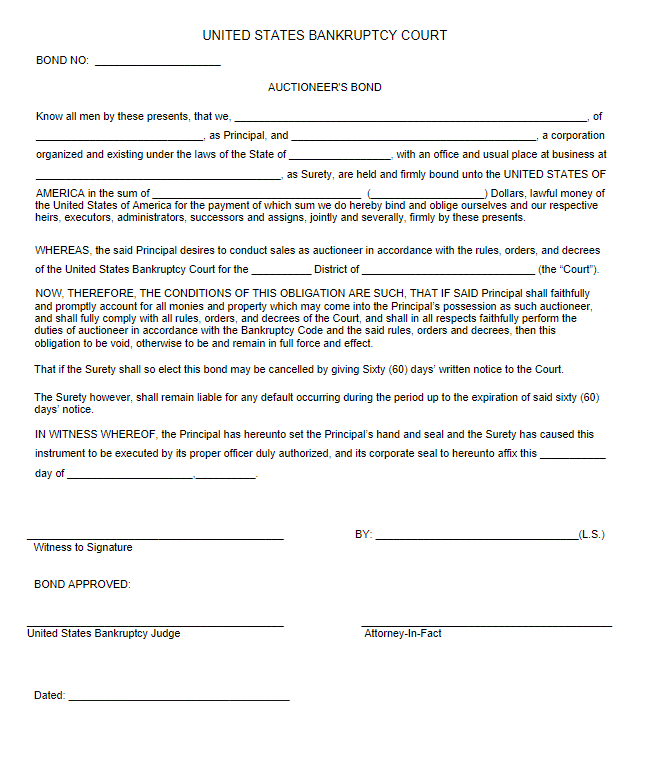

How do U.S. Bankruptcy Court Auctioneers File Their Bonds?

Bankruptcy auctioneers should submit their completed bond forms, including the power of attorney, to the bankruptcy court with jurisdiction over the estate.

The bond requires signatures from both the surety company that issues the bond, the bankruptcy auctioneer, a witness confirming their signature, and the bankruptcy judge presiding over the case. The surety company should include the following information on the bond form:

- Legal name and address of the entity/individual(s) buying the bond

- Surety company’s name, address, and state of incorporation

- Court where the bond is filed

- Date the bond is signed

What can U.S. Bankruptcy Court Auctioneers do to Avoid Claims Made Against Their Bonds?

To avoid claims against their bonds, bankruptcy auctioneers must ensure that they:

- Do not engage in any acts of theft or embezzlement

- Sell all property for reasonable prices to independent buyers

- Promptly remit all auction proceeds

- Maintain an accurate record of all transactions

- Do not mishandle the estate’s assets

What Other Insurance Products Can Agents Offer Bankruptcy Auctioneers?

Trustees may require auctioneers to purchase insurance for lost or stolen property. Bonds are our only business at BondExchange, so we do not issue liability insurance, but our agents often utilize brokers for this specific line of business. A list of brokers in this space can be found here.

How Can Insurance Agents Prospect for Bankruptcy Auctioneer Customers?

Insurance agents should contact the U.S. Trustee(s) with jurisdiction over the state(s) they are licensed in to obtain a list of bankruptcy auctioneers. Contact BondExchange for additional marketing resources. Agents can also leverage our print-mail relationships for discounted mailing services.