Mississippi Notary Public Bond: A Comprehensive Guide

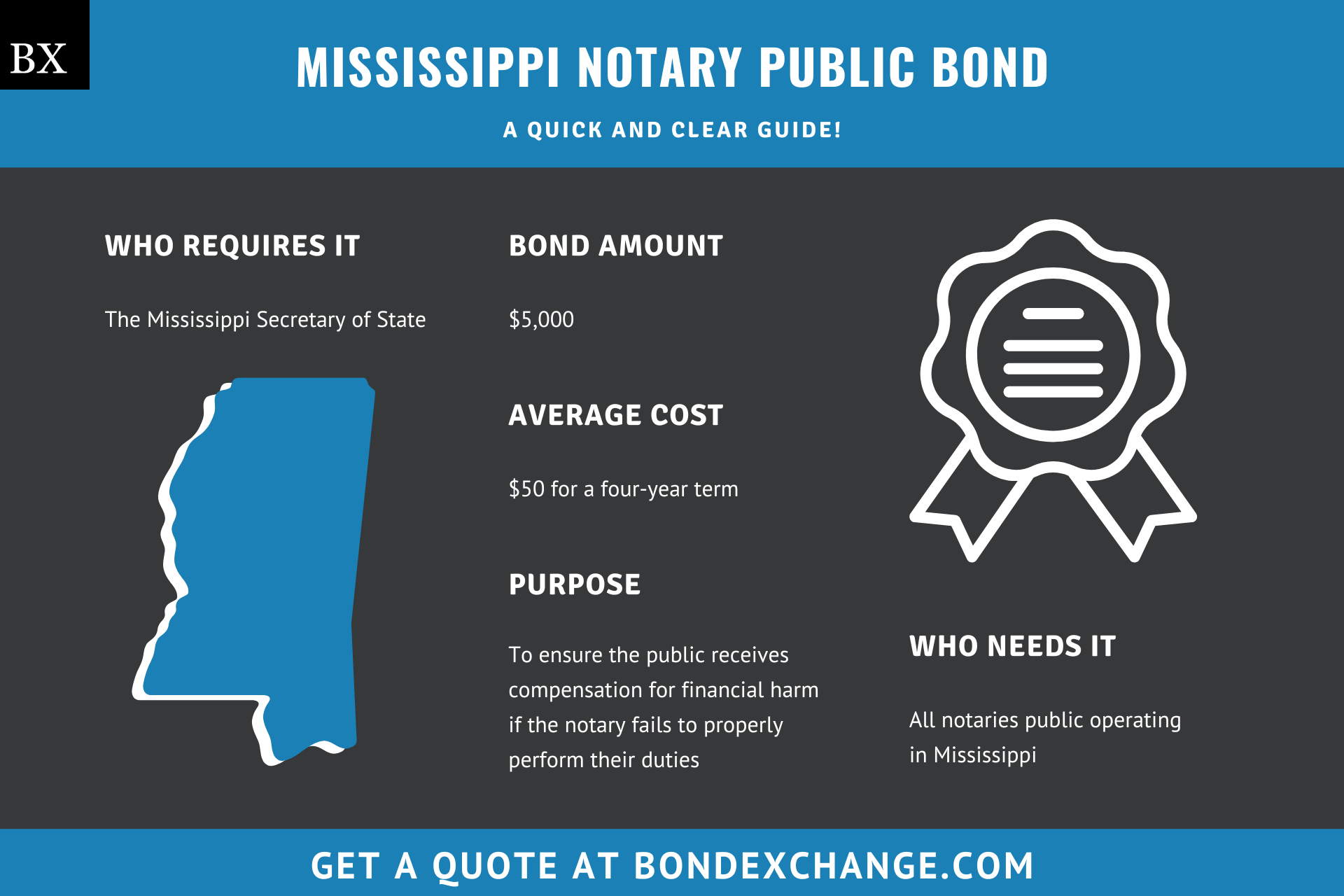

At a Glance:

- Average Cost: $50 for a four-year term

- Bond Amount: $5,000

- Who Needs it: All notaries public operating in Mississippi

- Purpose: To ensure the public receives compensation for financial harm if the notary fails to properly perform their duties

- Who Regulates Notaries Public in Mississippi: The Mississippi Secretary of State

Background

Mississippi Code 25-34-41 requires all notaries operating in the state to obtain a commission from the Secretary of State before performing notarial acts. The Mississippi legislature enacted this requirement to ensure that notaries engage in ethical business practices. To provide financial security for the enforcement of the commission requirement, notaries must purchase and maintain a $5,000 surety bond to be eligible for a commission.

What is the Purpose of the Mississippi Notary Public Bond?

Mississippi requires notaries to purchase a surety bond as a prerequisite to obtaining a notary commission. The bond protects the public from financial harm if the notary fails to comply with the regulations outlined in Mississippi Code 25-34-41. Specifically, the bond protects the public if the notary signs any documents for persons committing fraud or does not actually witness the signatures on documents being notarized. In short, the bond is a type of insurance that protects the public if the notary violates the terms of their commission.

How Can an Insurance Agent Obtain a Mississippi Notary Public Surety Bond?

BondExchange makes obtaining a Mississippi Notary Public bond easy. Simply log in to your account and use our keyword search to find the “Notary” bond in our database. Don’t have a login? Gain access now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone at (800) 438-1162, email, or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

Not an agent? Then let us pair you with one!

Click the above image to find a BX Agent near you

Is a Credit Check Required for the Mississippi Notary Public Bond?

No, a credit check is not required for the Mississippi Notary Public bond. Because the bond is considered relatively low risk, the same low rate is offered to all notaries in the state regardless of their credit history.

How Much Does the Mississippi Notary Public Bond Cost?

The Mississippi Notary Public bond costs just $50 for a six-year term.

Who is Required to Purchase the Mississippi Notary Bond?

Mississippi requires notaries public to purchase a surety bond as a prerequisite to obtaining a notary commission. To paraphrase Mississippi Code 25-34-7, a notary public is a public official authorized to provide the following services:

- Take acknowledgments

- Administer and/or take verifications of oaths and affirmations

- Certify depositions of witnesses

- Witness or attest signatures

- Make or note protests of negotiable instruments

- Make and file affidavits attesting to the validity of signed documents

Notaries who wish to perform in-person electronic notarizations do not need to purchase an additional surety bond. In electronic notarizations, the notary uses a digital signature and is physically present. Remote notarizations are not allowed in Mississippi.

BondExchange now offers monthly pay-as-you-go subscriptions for surety bonds. Your customers are able to purchase their bonds on a monthly basis and cancel them anytime. Learn more here.

How Do Notaries Apply for a Commission in Mississippi?

Notaries public in Mississippi must navigate several steps to obtain a commission. Below are the general guidelines, but applicants should refer to the Secretary of State’s website for details on the process.

Commission Term: All Mississippi Notary Public Commissions are valid for four years from the date of issuance.

Notaries Public

Step 1 – Meet the Qualifications

To be eligible to apply for a notary public commission, applicants must meet all of the following criteria:

-

- Be at least 18 years old

- Be a citizen or permanent legal resident of the United States

- Be able to read and write English

- Live in Mississippi for at least 30 days before applying

Step 2 – Complete the Application

Notaries must submit a notarized application to the Secretary of State at the following address:

Business Services Division

P.O. Box 136

Jackson, MS 39205-0136

Notaries must complete the application in its entirety and submit a $25 application fee.

Step 3 – Purchase a Surety Bond

Notaries public are required to purchase and maintain a $5,000 surety bond. Notaries must file a bond within 60 days of submitting their application or they will be required to restart the commission process.

Step 4 – File with the Secretary of State

Once their application is approved, notaries will receive an email from the Secretary of State with their pre-commission certificate along with instructions on how to file their bond and take their oath. Notaries must file their completed bond form and take an oath of office at the Secretary of State’s Office at the following address:

125 S. Congress St

Jackson, MS 39201

After filing their bond form and oath, notaries will receive an official commission certificate via email which will authorize them to start providing notarial services.

Electronic Notarizations

Step 5 – Select an Approved Technology Vendor

After receiving their notary commission, notaries public can register to perform in-person electronic notarizations by first selecting a technology provider to use. The system must meet the minimum criteria, and notaries may choose from the approved vendor list provided by the state.

Step 6 – Submit an Application

Notaries must submit an application online to the Department of State prior to performing any electronic notarizations. Once the Secretary of State approves the application, the notary may begin providing in-person electronic notarizations.

How Do Mississippi Notaries Public Renew Their Commissions?

Notaries must apply for a new commission before their existing one expires, as there is no specific renewal process. Notaries are encouraged to renew their commissions before the expiration date to avoid a lapse in commissions. All Mississippi Notary Public Commissions are valid for four years from the date of issuance. Electronic notary registrations run concurrently with existing notary public commissions and will expire on the same day

What are the Insurance Requirements for Notaries Public in Mississippi?

Mississippi does not require notaries to purchase any form of liability insurance as a prerequisite to obtaining a commission. Notaries public must purchase and maintain a $5,000 surety bond.

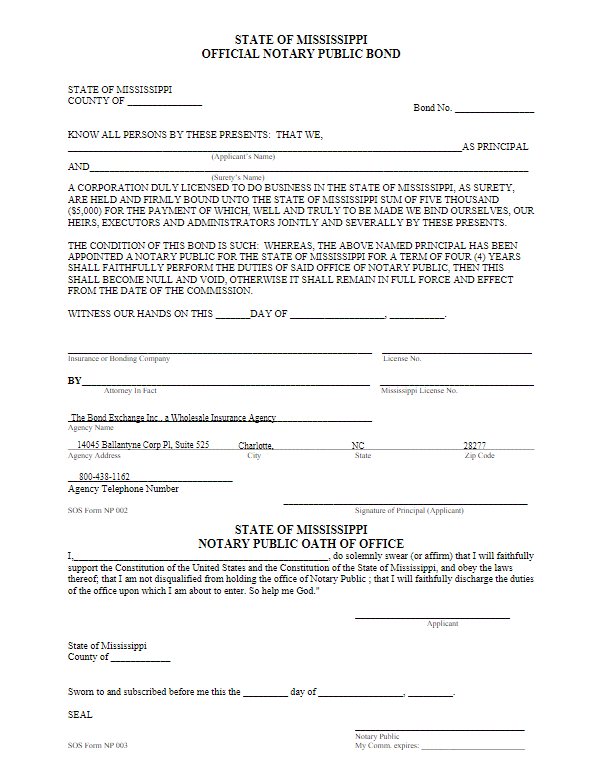

How Do Mississippi Notaries File Their Bonds?

Notaries public should file their completed bond forms, including the power of attorney, with the Mississippi Secretary of State at the following address:

125 S. Congress St

Jackson, MS 39201

The bond requires signatures from both the surety company that issues the bond and the notary. The surety company should include the following information on the bond form:

- Legal name and county of the entity/individual(s) buying the bond

- Surety company’s name, address, phone number, and license number

- Date the bond is signed

Notaries must file a bond within 60 days of submitting their application or they will be required to restart the commission process.

What Can Mississippi Notaries Do to Avoid Claims Against Their Bonds?

To avoid claims on their bonds, notaries public in Mississippi must adhere to all state regulations, including some of the most important issues below that tend to cause claims:

- Do not leave any notary supplies (seal and journal) in a place where they can be easily stolen

- Do not perform notary services for entities/individuals who are engaged in acts of fraud

- Ensure that the signers of documents are who they say they are and are not misrepresenting themselves

- Witness the signatures of all documents being notarized

- Record all transactions in a notary journal

What Other Insurance Products Can Agents Offer Notaries in Mississippi?

BondExchange offers free notary E&O insurance with the surety bond purchase for notaries in Mississippi. Unlike a surety bond, E&O insurance protects the notary rather than the public.

How Can Insurance Agents Prospect for Mississippi Notary Customers?

Mississippi conveniently provides a public database of commissioned notaries operating in the state. Contact BondExchange for additional marketing resources. Agents can also leverage our print-mail relationships for discounted mailing services.

What Other States Require Notary Bonds?

29 states and the District of Columbia require notaries to purchase a surety bond as a prerequisite to obtaining a commission. Insurance agents should utilize our Main Notary Bond Page for a detailed analysis of the Notary Bond requirements nationwide.